Road transportation prices on the French market rose by a meager 0.3% in September compared to August on our monthly Upply barometer. This is not enough to stem the inevitable fall in prices observed over the past year which was amplified by the Covid-19 crisis.

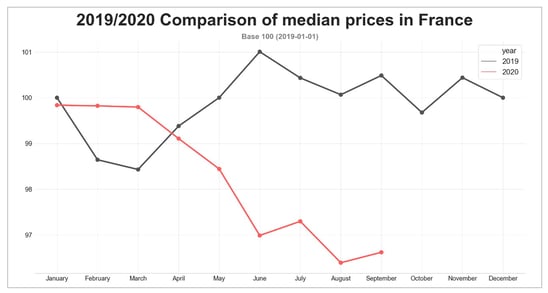

The transportation price curve in France showed a slight increase of 0.3% in September, which did not compensate for the drop in August that we characterized as seasonal in our previous monthly analysis. The result is that price erosion over one year reached -4.6% in September, against -4.3% in August and -3.7% in July. There is clearly a continuous decline in prices in France that we can see illustrated in the graph below.

Source : Upply

Weakening recovery

The strength of the recovery and the renewed optimism that we saw in June and July of this year have been eroded as summer came to an end. The morale of French bosses is “flagging”; the monthly increase in the business climate (see table at the end of the article) is only 2% against 8% in July and August. INSEE also mentions “a rebound tempered by uncertainty over the outlook for business activity”.

The Banque de France is on the same wavelength. In its update on the French economic situation at the end of September 2020, it can be observed that in September, business activity is generally stable according to business leaders and strong disparities can be seen between sectors. The evaluated loss in GDP remains at -5% for September as it was in August.

Unsurprisingly, the food and pharmaceutical sectors come closest to the full activity experienced before the pandemic. On the other hand, catering and accommodation, energy and manufacturing show the largest declines.

Carriers: a sector whose health depends on industry

Under these circumstances, the activity of specialized carriers follows that of their sectoral niche.

Companies with a strong presence in the pharmaceutical, food and home delivery sectors are doing well. They benefit from three favorable factors:

- significant or greater activity than before the pandemic,

- less foreign competition in these markets

- lower operational transportation costs (see table below).

On the other hand, highly specialized carriers in sectors heavily affected by the consequences of the pandemic have no choice but to resort to furloughing their staff to limit their losses. But they are under considerable pressure: declining volumes, customers putting out to tender in an aim to reduce costs, foreign competition in dry palletized traffic and underutilization of rolling stock weigh heavily. The situation of their treasury is coming under close scrutiny.

Carriers with a more diversified business portfolio may try to allocate their means and resources differently. This can only work if they have agile operations, motivated drivers and expert workshops. Companies that used to manage excess volume by subcontracting will retain this transportation for their own fleet of vehicles and therefore resort less to external providers.

The decline in prices to continue

In summary, regular traffic in the more affected areas is under pressure from tenders aimed at lowering prices, and spot traffic is falling sharply. Regular transportation prices have and will continue to fall and spot prices will tumble, often with 2-digit declines.

While waiting for the second wave of the coronavirus epidemic that is now on the horizon, the wheels that will ensure that prices continue to inexorably decline have been set in motion.

KEY INDICATORS

Source : Insee, CNR

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article