The rebalancing of supply and demand has given back control of pre- and post-shipment inland container transport to shippers and forwarders.

At the height of the Covid-19 pandemic, shipping companies were easily able to force their clients to accept carrier haulage rather than merchant haulage. This meant that pre- and post-shipment inland container transport was carried out by the shipping company.

The shipping companies were in a position of strength, since they controlled access to what was then a rare commodity : space aboard ship. They, therefore, offered their clients their services on a take-it-or-leave-it basis. What little room was left for negotiation over the ocean freight rate often depended on the client's agreement to hand over to the shipping company responsibility for road container transport to and from port. Naturally, this service was generally charged at the top rate on the basis of an outward journey with an empty container and a return journey with a full one.

The rebalancing of supply and demand since the summer and, in even more marked fashion, in the last few months, has left forwarders in a position of strength in relation to the shipping companies. As freight providers, they are sought after. The pre- and post-shipment road market has thus returned to such fundamentals as :

- Rate negotiation

- Billing for single journeys from inland container parks rather than forced billing for return journeys

- The negotiation of pick-up fees for bring empty containers from inland container parks and drop-off fees for returning them to a place close to where the goods are to be unloaded, so as to avoid having to return systematically to port.

Forwarders and shipping companies need to make up for part of the fall in their revenues caused by the fall in ocean freight rates by billing for additional services if they want to maintain their operating results. Various surcharges have been reintroduced by the shipping companies, while billing for additional services has become a crucial financial issue for forwarders.

Price differential

Let us take the example of goods in the Paris region which are to be put into a 40' dry container for loading aboard ship in the port of Le Havre. They are handed over to forwarder X for loading by shipping company Y.

- Option 1 : carrier haulage

Road haulage is arranged by shipping company Y, which charters and therefore assumes responsibility for road transport for his forwarder client.

> The impact on forwarder X

Advantages : only one bill is needed for the whole combined transport operation and transit procedures are simplified.

Disadvantages : a loss of revenue and profit margin on the operation.

> The impact on shipping company Y

Advantages : better control over the overall transport operation and inland container depots, additional revenue and profit on each box handled.

Disadvantages : the road transport charterer, in this case the shipping company, is exposed to the risks normally borne by the forwarder. It is for this reason, moreover, that there must be at least one person with forwarder accreditation in the shipping company's chartering service.

In this instance, the price will be calculated on the basis of a 220 km outward journey from Le Havre to the Paris region with an empty container and a 220 km return journey to Le Havre with a full container. There will also be a fuel surcharge adjustable on a monthly basis. In April 2023, the total bill for the 40' trailer came close to €600, which shipping company Y billed to forwarder X as a pre-shipment carrier haulage operation. The shipping company can add to this the ocean freight rate if this is payable on vessel departure.

- Option 2 : merchant haulage

Forwarder X takes direct responsibility for pre-shipment inland road transport. In this case, the shipping company will offer either to make available an empty container free of charge at the loading port, which is the minimum it can offer, or, for a pick-up charge, make one available in an inland container park, close to the place where the goods are to be loaded.

Depending on the company and the state of its stocks in the inland park, the forwarder can opt for a round-trip or for a one-way trip.

1/ In the first instance, the forwarder will normally be offered a price slightly lower than that charged for carrier haulage, given that forwarders normally have greater negotiating power than the shipping companies, thanks to the amount of road transport they buy and their ability, in certain cases, to use their own transport capacity. In this instance, the forwarder will pay about €560. On the other hand, the forwarder will have to manage the land transport operation and the operational risks that come with it. For a price difference of €40 by comparison with carrier haulage, this is hardly a great gain.

2/ In the second instance, the forwarder will, with the agreement of the shipping company, instruct his transporter to pick up the empty container at Gennevilliers in return for payment of a pick-up charge of about €40 and then position it for loading in the Paris region for a return fully loaded to Le Havre. From Le Havre, it is easy for the haulier to pick up an import container for another client, given that the chances of having to leave port without a load are negligeable.

It is the opportunity to make one-way trips which makes merchant haulage pertinent. The distance covered by the container for the pre-shipment transport leg comes down to about 250 km and the overall cost of transport, including the pick-up charge, is reduce to €380-400. In this instance, the gain is sufficiently attractive and remunerative to justify the forwarder opting to forgo the greater simplicity offered by carrier haulage.

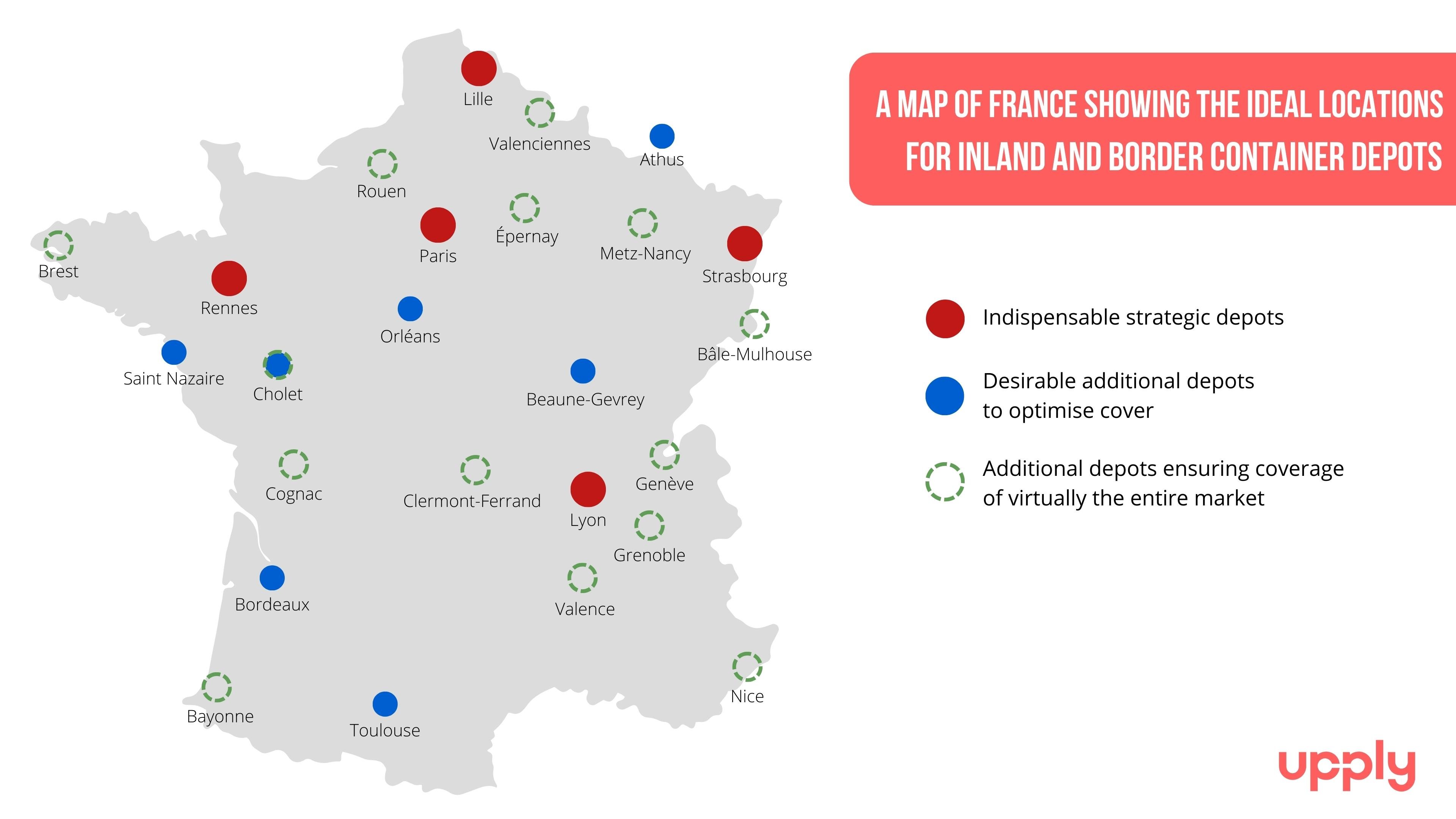

As for the shipping company, it avoids the risk of having to bring the empty container back to port at its own expense in the event that it is not used. On the other hand, it has to supply the inland depots with empty containers at its own risk (and expense), so as not to disappoint its clients. For example, a shipping company wanting to export via the port of Fos would have to make empty containers available in Lyons.

Inland parks

In a market in which operators are ready to compete for €25 worth of additional profit per operation, merchant haulage is being given close attention again.

The size and number of inland container parks and the regularity of shipping services are key to the good management of cargo volumes in a market in which freight rates are low. From this point of view, the greater the shipping company's field of action, the more easily it can respond to and satisfy its clients' demands. It can exercise tight control of the cargo coming in and out of each depot, with the clear aim of reducing to a minimum the number of empty containers it needs to transport at its own expense.

The question is a truly strategic one. To take again the example of the Lyons market, we can see that the freight rate alone does not allow one shipping company to differentiate itself from another. The availability of empty containers in Lyons, on the other hand, is a deciding factor in a customer's choice of shipping company, much more so than the choice or cost of the shipping service itself.

Source: Upply

Market recomposition

The old saying that shipping battles are won onshore was little taken into account between summer 2020 and summer 2022, which was a period of unprecedented prosperity for the shipping companies. Basically, everyone knew that it was a market anomaly. Today, however, the boomerang is returning.

Meanwhile, capacity has been consolidated among the top five shipping companies and forwarders. It is not going to be easy for the smallest operators, who are not going to be able to match the offers being made by the big groups, as the market becomes hyper-competitive and access to road haulage capacity becomes a major issue.

The road shipping container sector is made up essentially of specialist middle-sized companies mostly based in the ports. Today, they face higher costs and an increasingly severe shortage of labour. It is difficult for them in these conditions to reduce their margins which, in any case, are not great. At the same time, these companies are making great efforts to renew their fleets of tractors to respond to increasingly strict environmental constraints. It is quite probable that emissions generated by the overland transportation of empty containers will one day be taken into account in the calculation of the overall impact of transport operations. On this basis, shippers will probably increase the pressure in favour of ecologically virtuous, one-way operations.

In this situation, the shipping companies which have taken advantage of their increased financial resources to go for greater vertical integration and take direct control of their land transport resources will have a real competitive advantage. They will be able to offer more options than the foreign shipping companies established in France which do not have direct control of their container road transport operations.

© Photo Credit: Anne Kerriou

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article