The last quarter of 2022 marks the end of a period in which freight rates have been exceptionally favourable to the container shipping companies. This period, which was caused by a reversal in the balance between supply and demand, lasted from May 2020 to September 2022.

The fall in spot rates in the transpacific and Asia-Europe trades has speeded up since the summer of 2022. The landing was finally a little harder than we foresaw in the three scenarios we presented at the start of the year, as Western demand collapses as a result of factors which were at once political, economic and technical:

- Political because of the constantly growing uncertainty generated by the tensions between Russia and Ukraine and between China and the US.

- Economic because of the massive, widespread inflation affecting companies' production capacity and household purchasing.

- Technical because storage depots are full, inciting companies to take up a waiting position and avoid placing new orders.

As we announced in our forecasts, however, 2022 will still be a historic one for shipping companies' financial results. Even if contracts are often renegotiated while they are being executed, the increase in the value of long-term contracts in 2021 has served, as the companies expected, as a shock absorber and softened the impact of falling spot rates.

1/ High point for shipping companies' financial results

For those shipping companies in the Top 10 which end their financial year on 31 December, 2022, profits should be double those of 2021, thanks to a particularly strong first half. The shipping companies which end their financial year on 31 March 2023 will probably register lower performances but should still report good profits.

During the first three quarters, high freight rate levels allowed the shipping companies to absorb substantial increases in their operating costs. The main increase was in fuel costs but there were also increases in cargo-handling, storage and inland transport costs, as well as in transit fees (like those for the Suez Canal), port dues and charges for related services like towage. There was also heavy investment in structural change in the form of energy transition and digitalisation and this, too, results in higher costs.

According to Upply's estimates, the rate required to generate a small operating surplus on direct port-to-port Asia-Europe voyages stood at around USD1,200 per 40' HC container before the pandemic. Taking account of the sharp rise in operating costs, we estimate that the rate now stands at about USD2,000 for a vessel with a load factor of 85%, which, in current conditions, is hard to achieve, even taking account of blank sailings.

We are already seeing spot rate quotes for December of around USD2,000, although, it is true, there are only a small number of sailings actually available. It is not difficult to understand, therefore, that the period of plenty is now over for the shipping companies. Accusations against them of market manipulation are collapsing of their own accord, which could work in their favour at a time when the exemption from European Union competition rules they currently enjoy is set to be renegotiated. Their existing exemption is due to expire in April 2024 and the authorities in Brussels are currently consulting interested parties before deciding whether or not to renew it.

The big forwarders have also been caught up in the current contraction of the market. This will inevitably have an impact on their financial results but with a time lag of about three months.

2/ The reconfiguration of the logistics sector speeds up

After two years of massive debt reduction, the big shipping companies have seen a radical improvement in their financial situation, and this has enabled them to diversify their activities.

As we approach the end of 2022, the composition of the big shipping groups has changed a great deal by comparison with the pre-pandemic period. Following the example of the Maersk group, the leading companies have all opted for vertical consolidation of the logistics value chain.

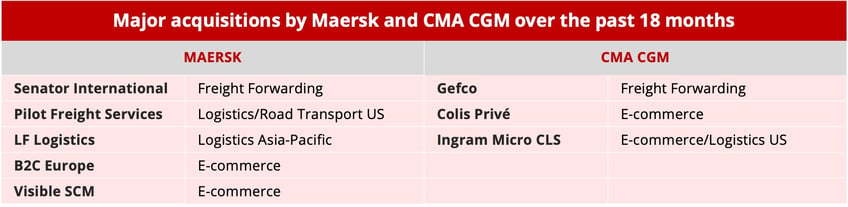

Data Source: press releases - © Upply

- Maersk and CMA CGM have made numerous acquisitions in the forwarding sector but also in e-commerce and logistics.

- MSC, which is today the leading shipping company in the world in terms of capacity available, according to the Alphaliner Top 100, has taken over the Bolloré group's African business activities.

- Cosco Shipping Holdings followed in the footsteps of its three main competitors by announcing that it was launching a Supply Chain Logistics division. According to a communiqué published by the group on 20 October 2022, the new division will have the job of "improving the resilience of Chinese industry's supply chain".

All these companies have been taking stakes in port terminals at a fast rate so as to consolidate their assets in this period of euphoria for operating results.

Finally, Maersk, CMA CGM and MSC have all gone into the air freight business.

The Maersk group is perfectly happy now to present itself not as a shipping company but as a "global logistics integrator", with shipping as just one of its different activities.

3/ Services still in a poor state

The shipping companies have not forgotten what overcapacity, now seen as their principal enemy, has cost them. When cargo is in short supply, their ships either do not sail or their departures are delayed.

What was exceptional has little by little become the new normal. People are getting used to the fact that "liner shipping" has now become "semi-liner shipping", with all the uncertainty that that creates for delivery schedules, disorganising supply chains one after the other. Data from Sea Intelligence shows that the situation varied over the course of the year, with a slight improvement in quality of service during the first half, followed by a new deterioration in the final quarter. This does not augur well for 2023, which looks likely to be full of complications.

The fall in shipping company revenues, combined with environmental demands and rising fuel costs, has also put paid to the fast premium services offered by Matson in the transpacific trades and Hapag Lloyd in the Asia/Europe trades. This is regrettable from a supply chain point of view, since these services allowed shippers to benefit again from ship speeds and transit times comparable to those available in the 2000s.

Super slow steaming has finally won the battle, therefore, and this will clearly be the case for a long time to come. Once again, this will not contribute to a long-term re-establishment of the performances of international supply chains.

It could provide ammunition for advocates of nearshoring, even if the interwoven nature of value chains makes this a complex process to carry out. Price fluctuations apart, the big shippers have understood that a return to pre-pandemic quality of service in terms of transit times and regularity is not the order of the day. In some sectors, like textiles, relocating production, principally in the Mediterranean basin, is becoming a pertinent option. As was pointed out recently by Benjamin Durand-Servoingt, chief operating officer at Groupe Etam, in an interview with the website Republik Supply, companies are having to rethink their strategies more because of supply difficulties and longer transit times than because higher transport prices.

4/ The energy transition exerts greater pressure

The shipping companies have had to go through a first stage of energy transition as a result of the introduction of the IMO 2020 regulation. They got through this stage relatively successfully despite their poor financial health at the time. Now, they have to prepare to meet two new deadlines. Using 2008 as the baseline, they will have to reduce their CO2 emissions by 40% by 2030 and by 70% by 2050.

In the meantime, they will have to comply with new ship decarbonisation standards which are due into force in 2023. Some have expressed dismay over this new technical, regulatory constraint, which they see as impossible to understand, let alone implement. Others prefer to say nothing, taking the view perhaps that the turnaround in the market will serve as a golden opportunity for taking capacity out of service through lay-ups or demolition.

What is certain is that the more difficult market conditions will incite operators to make major fleet changes by removing their most polluting vessels. The demolition yards, which had been little required during a period in which everything which floated was brought into service, are seeing their orderbooks fill up for the end of the year and the first half of 2023.

As regards solutions, the technical debate is becoming clearer as a distinction is made between transitional energy sources able to drive the internal combustion engines which remain essential for deep sea transport and the other systems for use after 2050, which will not use internal combustion engines.

Growth in the use of LNG has been blocked for the time being by the impact of the war in Ukraine and the total destabilisation of gas markets, not to mention the questions being raised about its environmental credentials by the environmental lobbies. In this situation, the e-methane and bio-fuel sectors seem to offer the best alternative.

Systems using a 70-30 ammonia/marine diesel oil mix represent a more radical solution but should still be seen as transitional. They can reduce emissions drastically and are approaching the technical maturity, thanks mainly to Japanese research, which will enable them to be brought into general use. Ammonia produces no polluting waste when it is used as a fuel, which is a major plus, even if a small quantity of diesel fuel has to be added to enable it to generate adequate explosive force in combustion chambers. The recent, huge increase in the price of gas, which is needed for large-scale ammonia production, is holding up development in this area, however, even though it seems for the time being to offer the best prospect of early introduction and reduced emissions.

The sail sector is also progressing, which is a good thing, even if it offers only a marginal response to the wider need to decarbonise the container shipping sector, whether for main or secondary propulsion purposes.

The cost of the efforts being made by the shipping companies on energy transition is starting to weigh heavily on them now that freight rates are falling again, and it seems clear that the cargo side will need to contribute to it. Some observers estimate that this will generate an additional cost of $200-300 for a 40' container on a deep-sea voyage. This will need to be taken into account when shippers negotiate their 2023 contracts.

5/ A geopolitical situation favourable for restructuring

This year could mark the end of globalisation as we have known it since the 1990s, which is to say as a source of constant growth in cargo volumes transported by sea.

Until now, only economic crises were likely to hold up growth in cargo volumes until trade took off again. The major geopolitical crises of the last three years have radically changed things, however. Western countries have taken the full measure of the need to re-establish their economic sovereignty. This is particularly the case in Europe, which was able to measure the scale of its dependence on China during the Covid-19 pandemic and its dependence on Russia following the start of the war in Ukraine.

The policies arising from this realisation could cause a long-term reduction in the size of the cake to be shared out among the shipping companies. On the major east-west routes, we are returning to 2018-2019 levels for the number of containers transported by sea. Of course, the main cause of this for now is the collapse of Western demand.

But other more structural factors, marking a real change of era, could come into play.

- As we have seen, nearshoring may be driven by purely economic considerations but can also be driven by political decisions to relocate strategic industries, as has happened in the semi-conductor industry.

- The ambitious climate targets set by the European Union could also modify the fundamentals of globalisation.

China's export industry is starting to feel the threat this poses, moreover. The Chinese government's insistence on pursuing a zero-Covid policy, coupled with weak Western demand, has created difficulties for the Chinese production system. Intra-Asian sea trade is still doing well but this is the only good news China has received in the second half. In the deep-sea sector, results are below expectation and the Chinese domestic market, which could have helped to maintain growth, is also marking time.

|

Low impact of the Russian-Ukrainian conflict The conflict between Russia and Ukraine has not had a major impact on container shipping. When the European Union introduced an embargo on Russian goods, the regular shipping companies cancelled their sailings to Russia. This decision caused the EU no financial pain and even had a beneficial effect, since these services were suffering from structural deficits. Containerised exports from Russia represented very small volumes even before the start of the conflict and Western shipping companies took advantage of the situation to repatriate empty containers on a grand scale. Russia, which imports containerised goods from Asia, was able to turn fairly easily to its Chinese neighbour and set up rail routes to get round the Western blockade. |

6/ Shipping companies as champions of sovereignty

This year saw a relatively important change in appreciation for the logistics sector generally but particularly for the shipping sector.

For a long time, China has used its big shipping and logistics groups - Cosco, Hutchison, Sinotrans and Cainao - as weapons of its economic expansion. Thanks to the crisis, which has disorganised supply chains, Europe has rediscovered the important strategic role played by the companies in these sectors.

This was what happened in France. The family-owned CMA CGM group, which has become extremely profitable after years of poor results, is now being seen as a political tool for the propagation of French influence internationally.

Its publicly proclaimed good relations with the French economy ministry and presidency, the early repayment of the emergency loan made available to it in late 2019, its cooperation with the state on such sensitive issues as Brittany Ferries, Air France, Gefco, Neoline, the La Provence newspaper and others show that the links between company and state are close.

Some see this as a legitimate repayment for past favours, given that the French state helped the company, as far as Brussels regulations would allow it, to pursue its development in in the 2000s in a difficult financial climate, when profits were low or inexistent. But it is also a mark of recognition on the part of the state of the strategic value of possessing a big shipping company.

When freight rates took off, the United States pointed the finger at "foreign shipping companies" which it suspected of suffocating American exporters, who regretted having abandoned their own shipping companies. Europe is suffering as a result of its lack of competitiveness in the energy field by comparison with the United States but has, on the other hand, a real asset in the shape of its shipping companies and big forwarding groups.

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article