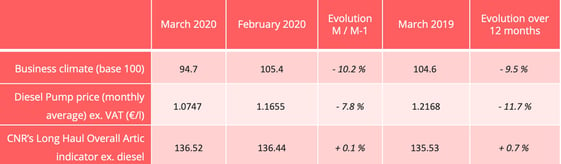

Road transport prices in March: misleading impression of stability in France

2min

Published at 17/04/2020

Updated at 10/03/2023

All our

articles