-2.jpg?width=730&height=395&name=en-Perspectives%20%C3%A9conomiques%202024%20_%20la%20volatilit%C3%A9%20reste%20de%20mise%20(2)-2.jpg)

Will the economic and geopolitical situation allow shipping companies to make a profit in 2024 ? Our expert, Jérôme de Ricqlès, takes the plunge and tries to provide you with some replies to the question.

This year, Upply is once again publishing its annual analysis of the outlook for the financial health of the leading container shipping companies. Last year, we predicted that the financial results of the top five operators would be markedly reduced but would nevertheless remain positive, despite the fact that the balance between supply and demand had turned in favour of shippers. This diagnosis was confirmed, even though the shipping companies did a little better than expected, thanks to an increase in freight rates at the end of the year, resulting from the attacks carried out on merchant ships by Houthi rebels in the Red Sea.

The increase in rates continued in January and February, enabling the shipping companies to make unexpected short-term gains. Most long-term contracts were suspended and have been either renegotiated or "corrected" to take account of the new situation. Now that rates seems to have reached a peak, let us consider whether the first quarter, which turned out more promising than the budget forecasts had predicted, will be enough to save shipping companies' full-year results, taking account of the different factors influencing their activity.

1/ The fuel factor

The Cape of Good Hope route between Asia and Europe, which has been widely adopted by the shipping companies as they seek to avoid the danger in the Red Sea, has become a sort of new normal, thanks to a return to classical market logic. With demand still weak, capacity is able to meet demand without great difficulty and we are seeing some normalisation on the freight rate markets, which have returned to the clear downward trend which had been in evidence before the first Houthi attacks.

There remains the question of costs, particularly fuel prices. It is highly likely that oil prices will increase in 2024, even though they are already at high levels. The new routes taken to avoid the Red Sea involve a 40% increase in the normal distance between Asia and Europe. Once again, therefore, fuel has become a major factor to take into account in this forecast. Its impact on cost structure is likely to become a point of comparison between the different operators in the market.

MSC, which has largely opted for a low-cost greening strategy based on the use of scrubbers, is in a good position financially speaking, since it can cover longer distances than its competitors at lower cost. The more distance a container has to be transported, the more the distance/cost ratio increases in favour of MSC. It is, therefore, able to reduce its rates to enable itself to continue increasing its market share.

2/ Blank sailings

The fact that ships are making longer round trips between Asia and Europe means that operators automatically lose a certain number of trips and, by the same token, potential revenues, in a fiscal year which, by definition, cannot be extended.

In this situation, continuing to delay or suspend ships' departures in relation to their original schedules is a way for the shipping companies to bet that the resulting reduction in capacity will enable them to achieve higher year-end profits. The wager is an uncertain one and dangerous, however, since it means further cuts in the number of voyages made, when these have already been reduced as a result of the introduction of longer routes.

Blank sailings are, therefore, a less attractive option for the shipping companies.

3/ Exogenous factors

Evaluating capacity development over the long term and the ability of the market to absorb it remains the central question with regard to future freight rate trends. Jan Tiedemann, VP Liner Strategy at AXS Marine regularly produces sparkling analyses on the subject.

But the market is showing itself to be increasingly at the mercy of exogenous factors, which we need to take more into account, therefore, in this forecast. We saw an example of this in 2023, when the Houthi rebel attacks in the Red Sea torpedoed the market forecasts drawn up at the start of the year, which had, until then, been in line with reality.

In 2024, the geopolitical situation is just as sensitive. The disruption in the Red Sea is continuing, tensions with Russia are increasing and there remains a real threat in the South China Sea, to mention only the main threat identified so far. Geopolitical factors need, no doubt, to be given greater weight in the 2024 forecasts, which should nor be based on a strictly endogenous view of the market.

4/ Chinese-American trade paradox

China and the United States continue to be the "best of enemies". Despite the real friction between them, however, the transpacific trade machine has clearly got back into gear, generating cargo volumes well above those of the Covid years, if the results of the main American ports in this early part of the year are to be believed. Apart from a good level of demand, the lack of water in the Panama Canal, which has resulted in restrictions on traffic using it, has led to Pacific traffic bound for the east coast of the US being redirected towards the west coast. This has brought an additional flood of full containers into San Pedro Bay.

The prospects for demand growth are such that a return to congestion in the ports of Los Angeles and Long Beach cannot be ruled out. “The resiliency of consumers continues to power the American economy and we are confident there will be moderate but steady growth through the end of the year," said National Retail Federation president and CEO Matthew Shay, when he presented the organisation's forecasts for 2024, Americans are continuing, therefore, to consume massive quantities of products manufactured in China and it can be clearly seen that the American retail sector is reconstituting its stocks again.

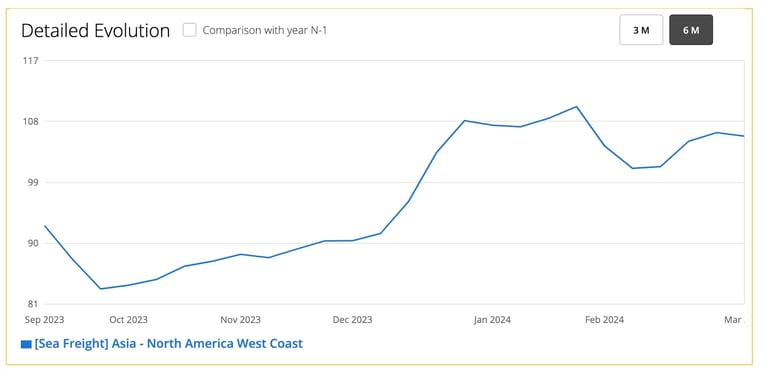

Freight rates are currently at a good level in the transpacific trades and are offering operators good returns. So true is this that commercial operating speeds have been slightly increased in these trades. It is too early to talk about a boom but the market is certainly in good health!

Source : Upply Freight Index

5/ Environment to lose out in 2024

Avoidance of the Suez Canal and to a lesser extent the Panama Canal in the first quarter has led to an increase in CO2 emissions from the shipping sector which we estimate at about 20%, compared to the first three months of 2023. With traffic growing faster than emissions, this is bad news for the sector's environmental performance, even though the majority of shipping companies are making a real effort to improve matters.

Whatever the reason, the fact that the container shipping industry is failing to reverse the CO² emissions trend is concerning, given the investment it has devoted to emissions reduction. Its inability to meet its goals looks very much like an admission of powerlessness on its part.

This deterioration in the industry's environmental performance has come just as it has begun implementing the European Union's emissions trading scheme (ETS), which came into force in the shipping sector on 1 January 2024. The event was relatively little noticed, given the increase in freight rates resulting from the crisis in the Red Sea, but ETS surcharges can be expected to increase.

In the big contracts, these surcharges are increasingly incorporated into freight rates. It would be logical, however, for these surcharges to be set according to the effort made by each operator to reduce emissions. This is not yet the case and it is regrettable, since the current approach renders the system less transparent and, therefore, less credible. The shipping companies, for which the management of carbon dioxide quotas represents an additional administrative task, would clearly like to have a margin in their favour between the cost of quotas and the amount passed on to clients. It will be important in this area to ensure that they receive a reasonable level of remuneration.

CONCLUSION : greater profitability in sight

To conclude and, before coming to a verdict on the likely profitability of the shipping companies in 2024, let us list the likely causes of rate hardening and softening on the ocean freight market.

Factors likely to push freight rates above shipping companies' break-even levels- Fuel prices

- Geopolitical and economic uncertainty

- The risk of open warfare

- The risk of market regulation

- The reconstitution of stocks after two years of adjustment, which is already boosting demand in the United States and could start doing the same in Europe in the second half.

- The big forwarders, which, by virtue of their size, are continuing to have an impact on the direction of the market and which, like the shipping companies, want to avoid another price war, so as to preserve their own profitability.

- Improved capacity management on the part of shipping companies on extended routes.

- An early reopening of the Red Sea to traffic with 100% security.

- A return to climatic conditions enabling passage through the Panama Canal to return to normal.

- A reduction in geo-strategic tension.

Taking account of the information we have following the end of the first quarter and, as we wrote earlier in the year, 2024 should normally be a more profitable year for the shipping companies than 2023, even though rates are unlikely to reach the levels seen in 2022. At this stage, we think that we can reasonably envisage an average increase of around 10% in EBITDAs and net incomes.

This would be a good performance. It is difficult to imagine a bigger increase, because, on the one hand, MSC is keeping a weather eye open to ensure it is able to hold on to its market share, and, on the other, because the shipping companies themselves have no interest in keeping today's extended routes in service longer than necessary, since they have a heavy impact on slot usage rates.

We need nevertheless to give a final warning, even if the risk it concerns underpins our entire analysis. A major geopolitical conflagration could bring shipping to a halt and cause a radical reorganisation of world trade. This still does not seem very probable but should not be ruled out entirely by supply chain risk management specialists.

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

7 min 03/03/2026Lire l'article

-

Subscriber France: Road transport prices remained almost stable in January

Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article