States and companies are seeking to reduce their dependence on China in some strategic sectors by diversifying sources of supply. As a world leader in the supply of intermediate goods, China nevertheless retains a strategic role.

“China Plus One”, as a strategy to reduce the dependence on Chinese supply, has gained growing attention amid the pandemic. While most of the attention is focused on the direct connection between China and the US or the EU, the ties between China and diversification host countries also deserve to be analyzed. Diversification can generate new demand from these countries for Chinese intermediate products, given that China is the world’s largest supplier of these goods. This article explores the trade connection between China and some popular diversification options, focusing on the trade in intermediate products.

Chinese Supply of Intermediate Goods: Overview

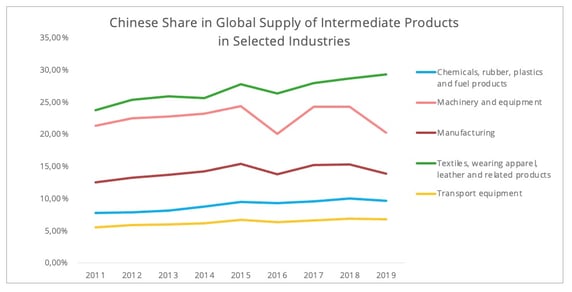

China supplied 14% of the world’s intermediate products in 2019 [1]. Industries actively seeking to diversify their supply chain are also the ones with the highest share of demand for Chinese intermediate products, such as the textile and apparel sector and machinery manufacturing sector (Figure 1).

Figure 1 - Data source: OECD Bilateral Trade in Goods by Industry and End-use

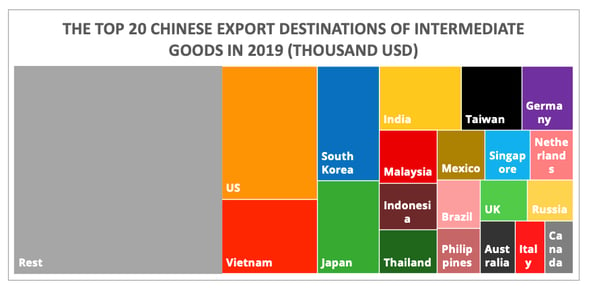

In terms of countries, among China’s top ten intermediate parts export destinations in 2019, five were also popular diversification destinations: four Southeast Asian countries, and India (Figure 2). As such, shifting parts of manufacturing activities outside of China is likely to create some increase in demand from inside the host countries for Chinese intermediate goods. This would likely to be the case for companies seeking to diversify the assembly lines for final products.

China's participation in the textile and apparel industry serves as a perfect example to illustrate this hypothesis. From 2010 to 2018, the Chinese share of exports of garments decreased from 37% to 31%, along with the shifting of manufacturing activity to South Asia and Southeast Asia. However, the Chinese share of textiles, the material for garment manufacturing, grew from 30% to 38% during the same period.

Figure 2 - Data source: OECD Bilateral Trade in Goods by Industry and End-use

Is such a phenomenon also observable in other industries, especially in light of the “China Plus One” trend? Here we try to explore the connection between China and diversification host countries primarily via two indicators:

- Firstly, China’s share in these countries’ imports of intermediate parts [2] over the years.

- Secondly, whether the imports of Chinese intermediate goods by these countries have increased, where there is an increase in exports of finished products from them to third parties, with a focus on the US and the EU.

--> Vietnam

Vietnam is identified as one of the most promising supply chain diversification destinations, especially for the ICT (Information and Communication Technology) manufacturing sector. China is Vietnam’s largest intermediate supplier, accounting for nearly one-third of all Vietnam’s imports of intermediate products in the manufacturing industry and more than a quarter in ICT manufacturing (Figure 3). With Vietnam’s high reliance on Chinese intermediate products, the relocation of manufacturing activities, especially final assembly lines, could tighten the trade in intermediate products between China and Vietnam. The lowered intra-Asian trade barriers under the Regional Comprehensive Economic Partnership could foster an intra-Asian supply chain.

Figure 3 - Data source: OECD Bilateral Trade in Goods by Industry and End-use

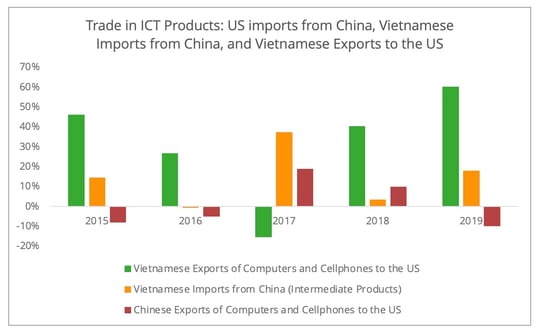

We will take the trade connection between Vietnam and China during the China-US trade war as a reference case. Due to the trade diversion effect, exports of Vietnam-made ICT products to the US increased by 66% from 2018 to 2019, while Chinese exports declined by 23%. However, along with Vietnam’s spike in exports of finished products to the US in 2019, Chinese exports of intermediate products in this sector to Vietnam also increased by 18% (Figure 4). Furthermore, the Chinese share in Vietnam's total imports of intermediate products in this sector also saw a modest increase in 2019, from 26.7% to 27.5%, indicating an active Chinese participation in Vietnam's ICT manufacturing activity.

Figure 4 - Data source: OECD Bilateral Trade in Goods by Industry and End-use [3]

Is a similar pattern discernible in nearshoring countries? It seems counter-intuitive for the nearshoring options to continue relying on the Chinese supply of intermediate goods. However, trade data from Mexico and CEE countries seems to tell a slightly different story.

--> Mexico

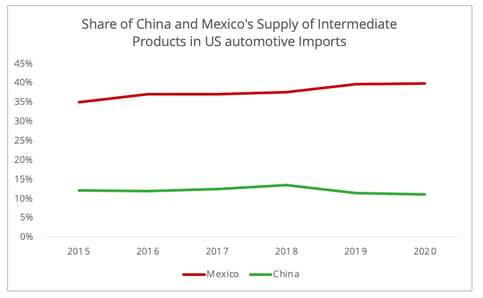

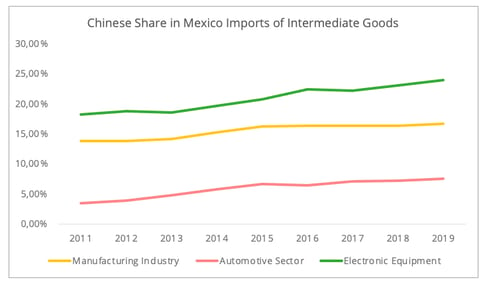

As a nearshoring option for companies targeting the US market, Mexico has benefited from trade diversion during the China-US trade war, for instance in the transportation equipment and electronic machinery sectors (Figure 5&6). During the same period, the supply of intermediate goods to Mexico also showed a growing participation of China in Mexico's manufacturing industry.

As for the automotive sector, a similar pattern may not be that easy to observe since Chinese exports to the US in the automotive sector are primarily intermediate goods rather than finished products. However, China will continue to supply raw material and components for manufacturing the intermediate products. For instance, the world’s manufacturers of electric vehicle batteries rely heavily on the Chinese supply of critical raw material.

Figure 5 & 6-Data source: OECD Bilateral Trade in Goods by Industry and End-use

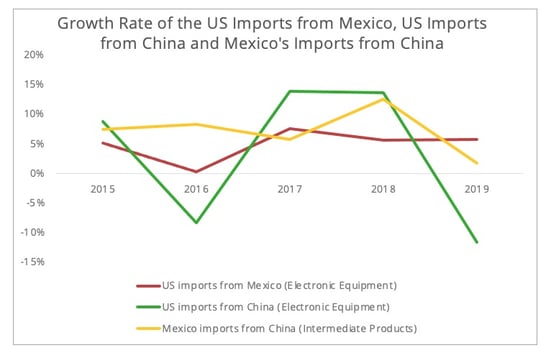

This tightened connection in intermediate supply between China and Mexico can be observed in the electronic machinery manufacturing sector. While US imports of Chinese electronic machinery dropped by 12% in 2019 due to the trade war, there was a 6% increase in Mexico’s exports of electronic equipment to the US market. At the same time, the intra-industry Chinese exports of intermediate goods to Mexico showed a modest 2% increase in 2019 (Figure 7).

Considering the US accounts for over 90% of Mexico's exports in this sector, we may conclude that the US demand for Mexican-made final products in the electronic equipment sector contributed to the continued increase of Mexico’s imports of Chinese intermediate products.

Figure 7 - Data source: OECD Bilateral Trade in Goods by Industry and End-use [4]

--> Central and Eastern European Countries

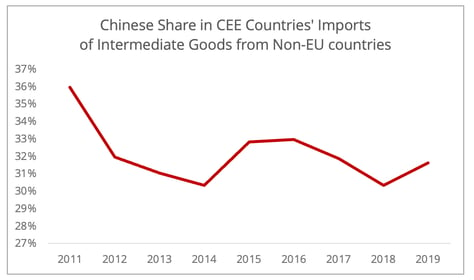

CEE countries are identified as the most preferred diversification option for the EU, especially for high value-added manufacturing industries. China accounted for about 32% of the CEE countries’ total imports of intermediate products from non-EU countries in 2019 (Figure 8) [5]. While there is no major incident occurring, such as the China-US trade war, to force trade diversion, the EU industrial strategy published last year also emphasizes the significance of strategic autonomy.

Figure 8 - Data source: Eurostat

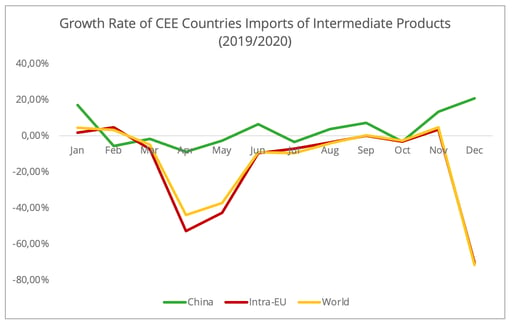

Nevertheless, the monthly trade data during 2020 indicates a strong share of Chinese intermediate products in the CEE countries’ manufacturing activity. The imports of Chinese intermediate parts rebounded quickly after the first Covid-19 wave in 2020 and surpassed 2019’s level in the summer of 2020 (Figure 9). In contrast, while intra-EU sourcing of intermediate components recovered to some degree, it finally remained below the previous year’s level. The sharp drop in intra-EU sourcing in December 2020 corresponds to the second wave of Covid-19 in Europe, with lockdown measures once again being implemented, which would also have resulted in an increase in demand to extra-EU suppliers. The recovery of Chinese productivity provided a necessary condition for China to continue participating in the European manufacturing industry.

Figure 9 - Data source: Eurostat

The Other Side of China Plus One

The above analysis seems to reveal a different side to the China Plus One story. While this strategy may have reduced the direct Chinese exports to the US or the EU in some specific sectors, there is continued Chinese participation in their supply chain via the supply of intermediate goods to the diversification host countries.

Indeed, companies are also actively seeking to secure alternative intermediate product suppliers. For instance, among the 30 Japanese companies that received government funding to relocate to Southeast Asia, 13 are manufacturers for intermediate parts and raw materials, and 17 for medical-related supplies. However, diversification cannot be achieved overnight. Along with the asymmetrical recovery of global productivity, an increase in trade between China and the host countries can be envisaged. This tightened connection may be followed by a slow but gradual decline in the long run for the following reasons.

- Firstly, intermediate product suppliers may be tempted to relocate closer to the assembly lines. For instance, Foxconn's establishment of new manufacturing plants in India has motivated multiple cellphone intermediate parts manufacturers to also establish factories in India. It is certain that India’s high level of import duty and the Production-Incentive Scheme contributed to the decision. Similarly, PSA’s new automotive manufacturing line in Morocco motivated multiple Chinese intermediate suppliers to invest in the regions around Tangier to support the supply chain.

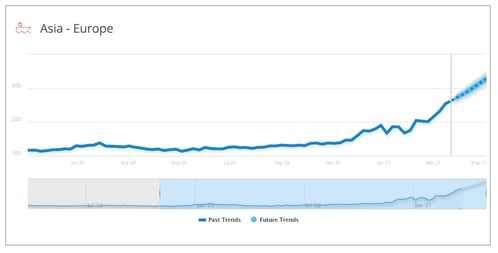

- Secondly, the on-going irregular ocean freight on Asia-Europe and Transpacific trade lanes also affects importers’ sourcing choices. The historically high freight rates on the Euro-Asia trade lane leads to European shippers sourcing for nearer suppliers, such as Turkey. These experiences reinforced the significance of diversification in their supply chain strategy. At the same time, China’s active engagement in emerging markets, such as Southeast Asia, and the stimulation policy towards domestic market demand perhaps shows the flip side of this tendency.

Source: UPPLY

- Thirdly, the growing state-level efforts in addressing supply chain security will help shorten the supply chain and boost its regionalization from a policy level. For instance, the US-Mexico-Canada trade agreement requires that 75% of the auto content be sourced within North America, which may result in a decline in demand for the Chinese supply of intermediate products. Similarly, the EU is also pushing for a pan-European supply chain in strategic sectors such as the pharmaceutical industry and the automotive industry.

[1] This is calculated by the author based on the OECD End-use data.

[2] The best way to evaluate global value chain participation is via the input-output table, but the latest data is only from 2015.

[3] & [4] This includes both capital goods and consumer products since they both require intermediate goods.

[5] The data is generated based on BEC division codes 530 and 420 provided by Eurostat.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article