Captain Upply is taking you on an expedition to the hinterlands of France’s largest ports. Our 30+ years of experience working with port operators in Paris, Marseille, and Le Havre give us the opportunity of showing a detailed picture of the day to day activities of container road transport throughout France.

Preamble

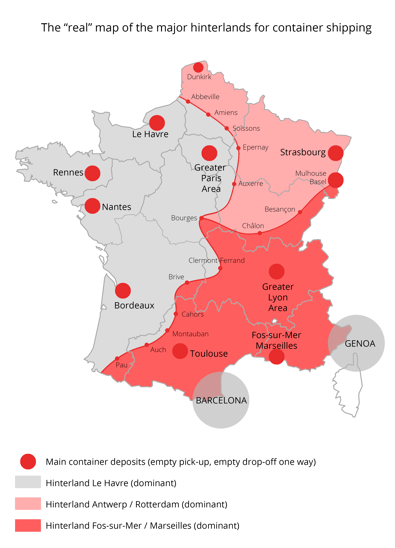

We define a major hinterland as one with the highest volumes. The limits of hinterlands are, by nature, constantly evolving, depending on the changes in the nearby ports’ service offering, active inland container depots, and on the level of urgency of the goods to be shipped.

This analysis does not include the combination of road transport with rail and river transport, which is an important means of connection with the nearby hinterlands. We’ll look at the impact of combined transport methods on hinterlands in a later publication focusing exclusively on the study of containerized combined goods transport.

Today, and this is unfortunate according to some, 82% of inland container transport is done by trucks (in terms of total volume). So, whether we like it or not, road transport is still the unavoidable mode of transport for pre and post delivery on land of maritime containers.

A word on the port of Dunkirk, which is here “integrated by force” in the hinterland of Anvers and Rotterdam. This simplification of presentation should not hide this port’s recent and significant leap forward in establishing close relationships with the major manufacturers and retail players in the Hauts-de-France region.

1/ LE HAVRE

This hinterland may be puzzling, with its close northern limit, due to the power and competitiveness of the ports of Belgium and The Netherlands. When looking at this map, it’s easier to understand why the port of Le Havre has always been weary of the speedway, represented by the Canal Seine Nord project…

Paris and its region are still the “beating heart” of Le Havre’s hinterland. It’s a vital zone – which we could almost qualify as a nonnegotiable – for investments in Port 2000 and the port reform in Le Havre.

In the east, the Champagne region is a breaking point materialized by equivalent prices between the ports in the North and in Le Havre. The port offering the highest quality of service and the largest departure catalog often takes the win for traffic that requires on site stuffing.

This is also an opportunity to point out that for the wine and spirits industry, consolidation and stuffing at the port are on the rise, which makes these breaking points in wine regions even crazier. Wine and spirits are, let’s not forget it, the number 1 type of good exported in containers at Le Havre, with over 100,000 TEUs per year.

Lyon is not relevant from a financial perspective when looking at trucking exclusively, in comparison to Marseilles-Fos, since traction prices are about twice as high. However, for rail-road transport, it’s a whole other story…

The western part of France drives down to the coast of the Aquitaine region. There are many non-road related options connecting this large area. Bordeaux, La Rochelle, Nantes Montoir, and Brest for containers are feeder ports with waterway connections to Le Havre (with the exception of the direct service to the West Indies from Montoir).

2/ MARSEILLES FOS

The greater Lyon area is to Fos-sur-Mer what Paris and its surrounding is to Le Havre: lungs, that are necessary to the port’s breathing.

Toulouse is also an important city for Fos, regardless of the Spanish conquest attempts via Barcelona.

The French departments of the Pyrénées Orientales (66) and the Alpes Maritimes (06) are staying vigilant, because of the attractiveness of the ports of Barcelona and Genova, both ambitious ports, even though the accident of the Morandi bridge in Genova in August 2018 allowed the port of Fos to increase its influence in the Alpes-Maritimes.

3/ ANTWERP AND ROTTERDAM

With their broad offer portfolio and a location at the crossroads of the well-developed European economies, these ports are powerful market leaders, offering work 24/7.

For the German economy, these two ports have become their go-to, especially Rotterdam, which drains a large part of the merchandise streams coming from North-West Germany.

For Belgium, Luxemburg, and the Netherlands, France is still an important variable, but not a vital resource, except for the Rhine region.

Until the access to Paris and its region becomes easier, the current equilibrium must be maintained (even if it is in a defensive way…). The issue may shift quickly as the Canal Seine Nord route becomes a reality (most likely in the next 10 years).

The relative failure of Zeebrugge, which is becoming apparent now, following the upfront competition of container shipping from Antwerp and Rotterdam, must be looked at closely. This port remains a well-suited location for VLCS. If I were Chinese, with the development of the new silk road, I’d take a second look. Some groups already did. In October 2018, the Chinese group Lingang signed an agreement of 85.3 million euros to establish a 30 hectare logistic park in the Maritime Logistic Zone in Zeebrugge…

Captain Upply

Photo credit: Anne Kerriou

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article