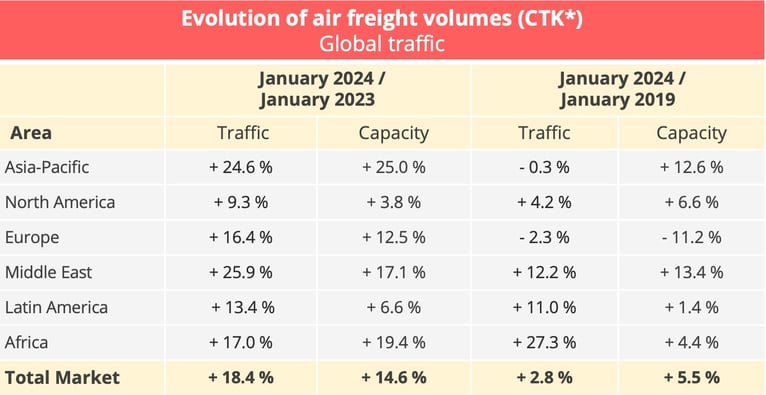

BAROMETER. Global air freight traffic increased 18.4% year on year in January 2024 to 20.8 billion tonne-kilometres. Rates, however, remain on a downward trend.

The air freight industry is sending out contradictory signals in this early part of 2024. Cargo volumes generally matched expectations. Traffic totalled 20.8 billion tonne-kilometres, 8.8% down on December, which marks the traditional seasonal peak, but up 18.4% year on year and up 2.8% up on the pre-pandemic month of January 2019. January was the second consecutive month of two-figure year-on-year growth, moreover. “Over the past three decades,” the International Air Transport Association (IATA) noted, "equally high annual growth rates have only been observed a handful of times, namely in the aftermaths of 9/11 (2002), the SARS outbreak (2004), the Global Financial Crisis (2009- 2010), and the COVID-19 pandemic (2021)."

* CTK : cargo tonne-kilometres - Source : IATA

In the present case, the growth can be partly explained by the disruption in the Red Sea caused by Houthi rebel attacks on merchant ships. Shipping transit times between Asia and Europe have been considerably increased, since ships are going round Africa via the Cape of Good Hope to avoid the Red Sea. Some goods needing shorter transit times may, therefore, have been switched to air transport. That said, IATA also notes with lucidity that the strong traffic growth in January "can be partially attributed to a base effect". It is true that, in 2023, traffic fell steadily throughout the first half on a year-on-year basis, before gradually starting to rise again.

IATA also highlights a more fundamental structural trend in air freight development. It considers that the growth in January also reflects the dynamism in international traffic, which is benefiting, notably, from a boom in electronic commerce. "This evolution propelled industry-wide demand for air cargo back above pre-pandemic levels in December (compared to the same month in 2019), to settle at +2.8% in January," it said. "By the same logic, SA CTKs (cargo tonne-kilometres) continued their upward trend in January and grew by 3.2% MoM (month on month) as well as 15.1% YoY (year on year). This marks a strong start into 2024…"

Traffic growth exceeds capacity

The comparative development of traffic and capacity is another positive element for the airlines. In January 2024, traffic increased faster than capacity, which rose 14.6% to 44.6 billion CTK. Load factor thus rose by 1.4 percentage points. This result contrasted sharply with that of the second half of 2023, when traffic began to increase again but at a much slower rate than capacity.

The difference is particularly spectacular on the global market, where the gap between traffic and capacity growth is 3.8 points, but it can also be seen on the international market, where traffic growth was 1.6 points higher than capacity growth.

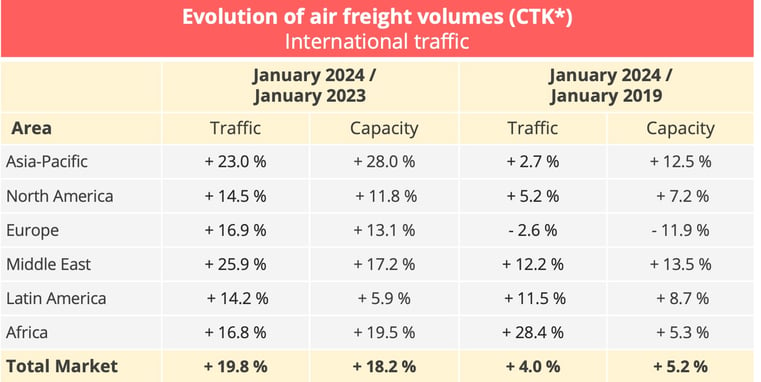

* CTK : cargo tonne-kilometres – Data source : IATA

Traffic trend influenced by the situation in the Red Sea

The spectacular growth of international traffic in January (+19.8% year on year) benefited carriers in all regions but the crown went to companies in the Middle East and Asia, where the increase exceeded 20%.

Once again, one of the explanations is the base effect but another is exceptional dynamism on certain commercial routes served by these companies. In January, Africa-Asia and Middle East-Europe routes saw their traffic soar 52.5% and 46.1% respectively. The Middle East-Asia and Europe-Asia routes also registered higher than average performances, with year-on-year growth of 29.5% and 27.5%. These performances can be explained, notably, by the disruption in the Red Sea, which led to some cargo being switched from sea to air transport or to a mixed sea-air transport solution.

These results helped the Middle Eastern and Asian companies to carry off the title for highest growth overall. The Middle East companies recorded a 25.9% increase in freight volume year on year and an 18.3% increase month on month, compared to a capacity increase of 17.2%. The Asian companies saw their cargo volume grow 23% under the impact of the growth on the international routes mentioned above but also on intra-Asian routes. Traffic on these latter routes was markedly higher than in December, with a 22.3% increase in January year on year, compared to just 9.1% in December. Asian carriers nevertheless saw their load factor deteriorate in January, when capacity also increased 28%.

Naturally enough, in this situation, the North American and European carriers also held their own. Traffic between Asia and North America was little affected by the situation in the Red Sea. It increased but in lower proportions (+17.1%) than. This was a higher increase than in December year on year, but Asian carriers clearly drew greatest profit from this growth, since the American companies registered a traffic increase of just 14.5%. The latter were not helped by the traffic trend on North America-Europe routes, which showed the lowest growth rate of all the major corridors - just 3.5%. European carriers lagged a little behind the general average but still saw traffic increase 16.9%. They were the only ones, moreover, to record a level of demand below the pre-pandemic level.

The African companies registered 16.8% growth, compared to just +0.6% in December. Like the Asian companies, they benefited from exceptional growth on Africa-Asia routes, even though traffic growth was lower than capacity growth. Latin American companies showed lowest growth at 14.2% but kept capacity growth down to 5.9%.

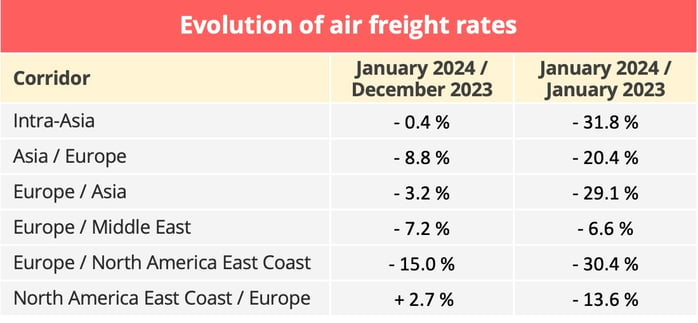

Freight rates fall

Despite traffic growth exceeding capacity growth, and despite a 3.7% increase in the cost of aircraft fuel between December and January, according to IATA, cargo yields (including surcharges) were down 10.4% on that of December and 23.5% down on that of January 2023, reversing the upward trend seen in December. It is true that, for several months, capacity has increased faster than demand. There is not yet enough pressure on capacity, therefore, despite the disruption in the Red Sea. Capacity remains sufficient against the background of a relatively unfavourable economic climate.

Source: Upply Freight Index

An upturn to be confirmed

According to IATA, the growth in air freight was higher than that of trade and production in January. Here again, however, there are contradictory signs on the economic front, which make it difficult to know if the air freight industry is on the verge of a real recovery or not.

On the good news side, we see that global cross-border trade increased 1% in December month on month even though it was 0.2% down year on year. Moreover, December 2022 was a time of vigorous post-Covid recovery. And, in January, the Purchasing Managers' Index (PMI) for manufacturing production rose to 50.3, exceeding the 50 mark for the first time in eight months, and thus moved back into growth territory.

On the other hand, the PMI for export orders remained below the 50 mark, even if it increased to 48.8, suggesting that exports are continuing to decline slowly but steadily worldwide. More generally, the short-term economic outlook is hardly encouraging. Inflation remains at a low level in the leading economies, according to the January consumer price indices, standing at 3.1% in the United States and the European Union. The American economy is showing some dynamism, but this is not at all the case in Europe. The increase in prices is slowing but has not been entirely matched by salary increases. This limits consumer purchasing power. Moreover, the very cautious policies followed by the central banks, which have postponed reductions in their policy rate out of fear of reviving inflation, is holding back investment.

Finally, the situation in China, which is the main driver of global economic growth, is preoccupying. In January, it recorded its fourth consecutive month of deflation, with a negative rate of -0.8% - the lowest since the global financial crisis in 2009. This deflationary trend is causing concern that it could lead to an economic slowdown in the wider region - one which is essential for the good health of the air freight industry.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article