.jpg?width=730&height=395&name=visuels-rs-market-insights%20(2).jpg)

With freight rates extremely low, the shipping companies need surcharges to increase their revenues.

The shipping companies are struggling at the moment to impose their general rate increases against a background of weak demand and a long-term surplus of shipping capacity. At the same time, the geopolitical situation is increasing their costs and their operating results have been deteriorating for several months. This convergence of factors is encouraging them to introduce temporary surcharges as a mean of compensating, at least partially, for current low freight rates.

The ploy is not a new one. The shipping companies have long used surcharges to pass on to the cargo side unforeseen additional costs and restore their profit margins. When freight rates soared after the Covid pandemic, the shipping companies soft-pedalled the surcharges, since freight rates were more than sufficient to cover costs. Today, however, the situation is radically different.

Higher surcharges in 2024

Some surcharges were expected, among them the surcharge for the Emissions Trading System (ETS) for CO² emissions, which is due to come into operation on 1 January 2024. Others surcharges, like those for war risks, have turned out to be much heavier than expected.

We see, therefore, that there is a strong possibility that surcharges could become a much larger component in the purchase of containerised freight services. In some cases, combined surcharges can account for 20% of the overall freight rate. Big shippers are in a strong position to get these charges incorporated more or less into their annual Beneficial Cargo Owner (BCO) freight contracts but, on the spot market, the surcharges are added to the basic freight rate. The shipping companies will do all in their power to ensure that these surcharges are applied, given that they represent a way of restoring the differential between spot and contract rates and, thus, of correcting an anomaly which they consider has lasted too long already.

1/ ETS surcharges a particular case

The European Union's Emissions Trading System (ETS) will be applied progressively in the shipping sector over a three-year period starting on 1 January 2024. The shipping companies will be obliged to declare their emissions and surrender an equivalent proportion of ETS emission allowances according to the following timetable :

- in 2024, 40 % of emissions declared will have to be covered by ETS emission allowances

- in 2025, the proportion will be increased to 70 %

- in 2026, all emissions will have to be covered by emission allowances

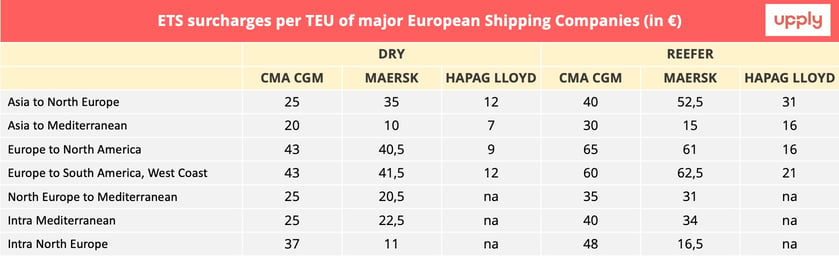

The system will, therefore, represent a cost for the shipping companies, which have announced that they will apply a surcharge to take account of it. This surcharge is particular, however, in that it will not be temporary but one which will apply over several years at least. At the start of autumn, the three leading European shipping companies published estimates of what these surcharges are likely to represent in early 2024.

These estimates, which have been supplied by the shipping companies, are subject to modification. *The Maersk estimates apply to 40' containers. We have reduced the amount by half to give a TEU estimate in equivalent to those issued by the other operators. Maersk itself could decide, however, to use another way of fixing its TEU rate. The companies' official communiques on the subject can be found by clicking on the links below. Data sources: CMA CGM, Maersk, MSC, Hapag Lloyd.

2/ Surcharges for war risks

Surcharges for war risks are applied when cargo transits close to conflict zones. Shippers contributes in a certain sense to the cost of keeping the service going when operating conditions have deteriorated and become dangerous. These surcharges are justified in theory by the fact that the insurers themselves apply surcharges to the shipping companies. This is not always the case, however, and there is, therefore, an opportunity here for the shipping companies to make some additional profit.

Today, there is no shortage of geopolitical hotspots. The war between Russia and Ukraine has made the Black Sea a particularly exposed area. In early October, a Turkish ship collided with a mine. For some years now, there has been an increasing number of incidents in the South China Sea. The resurgence of the Israeli-Palestinian conflict, with the risk it brings of regional contagion, has revealed the threat posed to one of the world's key cargo transit zones. Locally, the impact is already being felt on services to ports in Israel. ZIM has announced that it is pursuing its activities but has applied a war risk surcharge.

For tanker operators, the Strait of Ormuz is known as a particularly sensitive zone but, if the conflict escalates, the nearby Gulf of Aden and Suez Canal cold also become exposed. In either case, container shipping would be directly affected. A blockage of the Suez Canal would force container line operators to make wholesale detours round the Cape of Good Hope. If this option, which is already used by some operators, became the norm, many more ships would have to be brought into service. This would not necessarily upset the shipping companies. Quite the opposite. But transit times would be considerably longer.

3/ Additional fuel surcharges

Over time, some surcharges have become a standard feature of freight rate calculations. This is the case, for example, of the Bunker Adjustment Factor (BAF) and the Currency Adjustment Factor (CAF). The same goes for the ISPS (shipping and port security) and MARPOL (ship pollution) surcharges.

There is currently a high risk of speculation on refined product prices, however. The difference between the price of IFO380 fuel, which stands at over USD500 per tonne, and VLSFO, which is currently traded at around USD600 per tonne on the open market in Rotterdam and Singapore, has narrowed. But these are high price levels in any case and, if there is a major escalation of the Israeli-Palestinian conflict, they are likely to become even higher. This means that there is a risk that a general Emergency BAF surcharge could be introduced to take account of these potential cost increases.

The use of alternative fuels, which are more environmentally friendly but more expensive, could also lead to specific new surcharges in additional to the existing Low Sulphur Fuel surcharge. Maersk has already done this as a means of covering the cost of using methane as part of its energy mix.

4/ Aden surcharge

This surcharge, which can be interpreted in a variety of ways, essentially exists to cover the extra cost of securing merchant shipping convoys crossing the Gulf of Aden. If the Israeli-Palestinian conflict spreads, however, the increased risk involved in transiting the gulf could result in a significant increase in this surcharge, which was originally created to cover the cost of anti-piracy measures.

5/ Suez Canal surcharge

The Suez Canal administration has just announced plans to introduce an additional 15% surcharge for Asia-Europe traffic from 15 January 2024. Again, if the Israeli-Palestinian conflict escalates, the cargo side could be asked to contribute to the cost of securing the Suez Canal militarily if it remains open. This would be in addition to war risk surcharges, which are based on the cost of insurance premiums.

6/ Additional congestion surcharges unlikely

Conversely, the port congestion surcharges, which flourished during the return to normal economic activity after the Covid lockdowns, are now a distant memory. With the exception of Turkish and Black Sea ports, these surcharges are now barely used by shipping companies anywhere on the planet.

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

7 min 03/03/2026Lire l'article

-

Subscriber France: Road transport prices remained almost stable in January

Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article