Road freight rates have increased in the European market in Q3 2025, both in the spot market and in the contract market, and the confidence index is improving. However, the recovery remains fragile.

The European road transport market continues to struggle in 2025. Road trade between the main European economies (Germany, France, Poland, Italy, and Spain) has tended to stagnate since the beginning of the year, and demand is only very timidly picking up.

- Industrial production is showing some signs of recovery, but in a very turbulent geopolitical context, setbacks are still possible.

- Retail trade remains in difficulty, as European households are tending to increase their savings. Nevertheless, at the end of the quarter, the first restocking effects were felt, in anticipation of the end-of-year holidays.

Moreover, the recovery remains very uneven across markets: Spain continues to show remarkable dynamism, while Germany, for example, continues to weigh on the entire market with a struggling manufacturing sector.

Rebound in freight rates

The slight recovery was nevertheless enough to raise freight rates back up in the third quarter 2025:

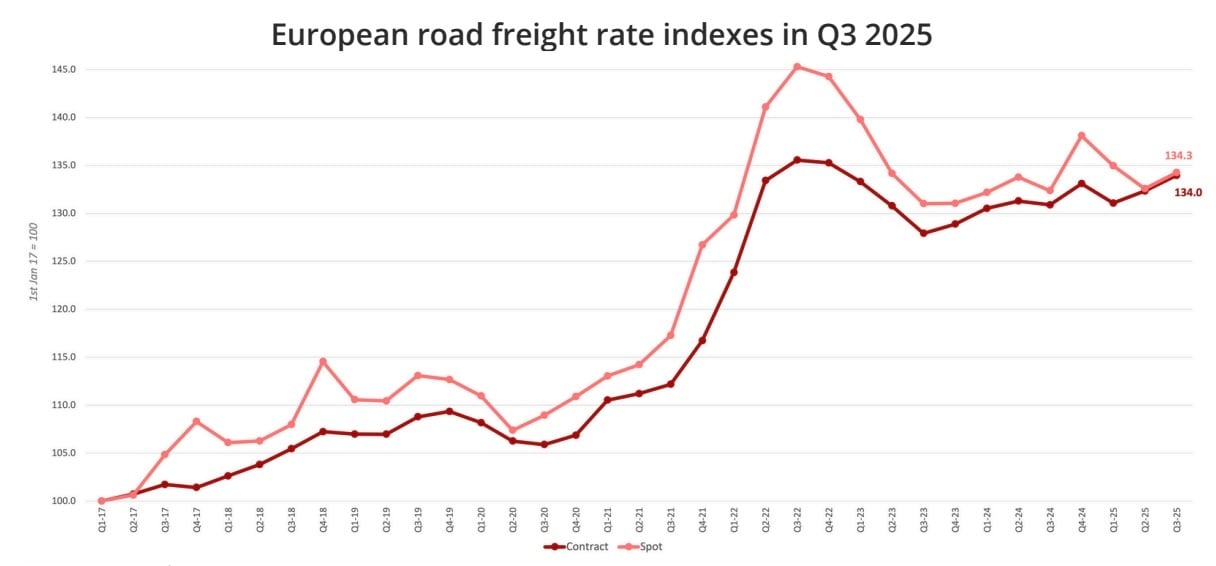

- The contract rate index stood at 134.0, an increase of 1.7 points compared to the second quarter and 3.1 points compared to the third quarter of 2024.

- The European road freight spot rate index reached 134.3 points, an increase of 1.7 points compared to the previous quarter and 1.9 points year-on-year.

Source: Upply

The contract market has probably benefited from the improved business climate in industry, which is driving companies to secure capacity. This is a sensible strategy. For now, given the low volumes, there are no difficulties in accessing the transport offer. But road transport companies are currently very cautious about making investments: new registrations of heavy goods vehicles are clearly trending downwards, which could create tensions in the market in the event of a stronger recovery.

The rise in transport prices on the contract market is also correlated with the cost increases faced by road carriers. Given the low margins in the sector, their impact, at least partial, is inevitable.

On the spot market, the trend reversed in the third quarter of 2025. After two quarters of decline, prices have started to rise again, but this remains moderate, which reflects the timidity of the recovery.

The holiday season could exert slight upward pressure. The Ti x Upply x IRU confidence index rose to 12.7, its highest level since the end of 2023. Most market players anticipate a moderate rise in rates in Q4, driven by:

- seasonal restocking

- rising demand for essential goods

- an improving industrial situation, despite the setbacks.

WHERE TO LEARN MORE

> See the webinar

> Download the Upply / Transport Intelligence report on European road freight rates as of the 3nd quarter of 2025

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article