INFOGRAPHICS. The 2022 statistical review of road freight transport in Europe shows market stagnation. Discover 5 infographics to better understand the main developments.

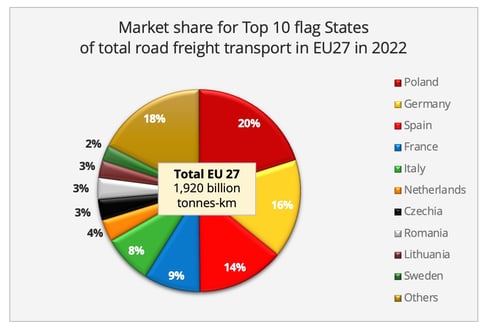

Road freight transport activity stagnated in the European Union in 2022, standing at 1,920 billion tonne-kilometres (btkm), according to Eurostat's statistical review published last September. It is nevertheless 5.5% above the pre-pandemic levels of 2019. Indeed, the activity had experienced a strong rebound in 2021, which had more than offset the erosion recorded in 2020 due to the Covid-19 pandemic.

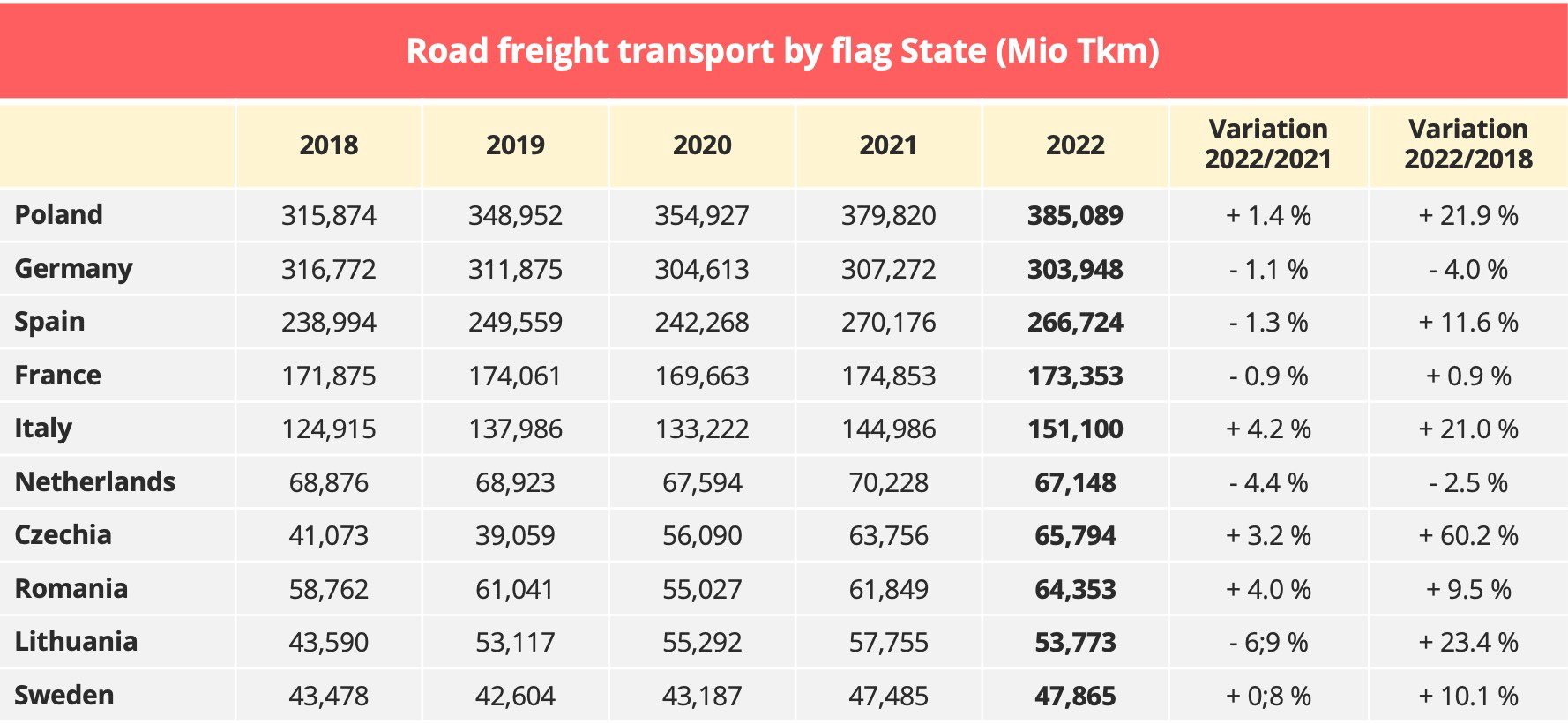

1/ The main European flag States

Data source: Eurostat

Between 2021 and 2022, the Top 10 European flag states remained unchanged. Five countries dominate the market, exceeding the 100 billion tkm mark: Poland, Germany, Spain, France and Italy. Together they account for almost two-thirds of the total European traffic.

Data source : Eurostat

However, the respective trajectories of the main European road transport flag states show significant variations, both year-on-year and over a 5-year period.

- Poland is now very firmly at the top of the market. Despite that given its geographical proximity it is particularly exposed to disruptions in activity related to the war in Ukraine, the country recorded a growth in road freight transport of 1.4%.

- Germany, the former market leader, confirmed its decline and is suffering the strongest erosion observed over 5 years in the Top 10.

- Spain has shown to have been affected by the ups and downs of the market. Hard hit during the Covid pandemic, road transport activity rebounded strongly in 2021, before retreating again in 2022, when the period of economic overheating began to abate. However, its progression over 5 years remains very positive, with double-digit growth.

- France is resisting a little better than Germany, but in 2022, it still fell slightly below the pre-pandemic levels reached in 2019.

- Italy stands out due to its good results. In 2022, the Italian flag state can boast having recorded the best growth rate in the Top 10, with an increase of 4.2%. Moreover, by exceeding the 20% increase over 5 years, Italy rivals the performance of Eastern European flag states.

Overall, in the Top 10, the progression over 5 years between 2018 and 2022 shows that 6 flag states experienced double-digit growth: Poland, Spain, Italy, the Czech Republic, Lithuania and Sweden. The Czech Republic took the lead in terms of growth (+60.3%). Until 2021, Lithuania was also on a very dynamic trajectory but the country experienced a very strong decline in 2022, penalised by the Russian-Ukrainian conflict. Its fall in activity of -6.9% is the strongest observed within the Top 10.

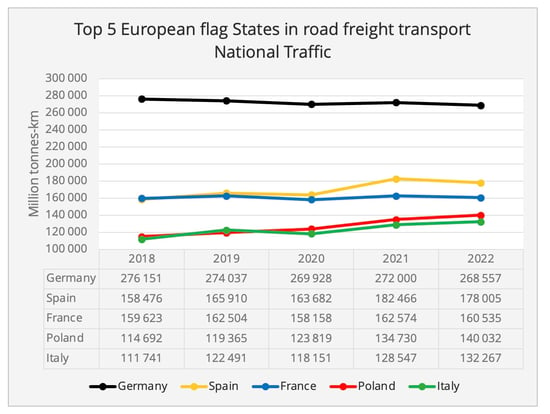

2/ National road transport

Data source: Eurostat

National road transport[1] for the EU-27 totalled 1,178 billion tonne-kilometres in 2022. A stable figure compared to 2021. The Top 5 represents 75% of the volumes.

- Germany remains largely in the lead, this pole position reflecting the weight of its economy and the size of its domestic market. However, domestic traffic returned to a downward trend in 2022 (-1.3% year-on-year) and remains below pre-pandemic levels.

- Spain, which snatched the No.2 spot from France in 2018, consolidates its position, despite a decline of 2.4% in 2022 compared to 2021.

- France also suffered a contraction of 1.3%, which brings national road traffic expressed in tonne-km below the level reached in 2019.

- Poland and Italy, unlike the top three, recorded growth in activity in 2022. The market grew by 8.8% in Poland and 2.9% in Italy compared to 2021.

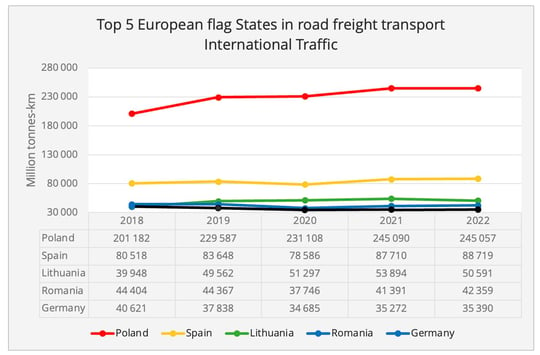

3/ International road transport

Data source: Eurostat

EU-27 international road transport[2] represented 742.8 billion tonne-kilometres in 2022. Again, this is a stable result compared to 2021, which shows that the different market segments were similarly affected by the slowdown in the economy.

- Poland, the unstoppable leader in this market, experienced stagnation in global international traffic in 2022. The drop in cabotage traffic (-12.6%, to 21.7 billion tkm) was offset by cross-trade activity (+4.5% to 74.4 billion tkm), while international traffic of goods loaded or unloaded in Poland remained stable.

- Spain showed a satisfactory performance compared to the average, with a growth of 1.2%.

- For Lithuania, on the other hand, 2022 marks a halt after years of spectacular growth that even the pandemic had not interrupted. International traffic fell 6.1% year-on-year. The erosion concerns both cross-trade activity (-4.1% to 34.7 billion tkm) and cabotage (-11% to 5.7 billion tkm) and international traffic of goods loaded or unloaded in Lithuania (-9.9% to 10.3 billion tkm). The 5-year increase is nevertheless 26.7%

- Romania, on the other hand, is doing relatively well, with growth of 2.3%. While cross-trade and cabotage activities declined, international traffic of goods loaded or unloaded in Romania increased by 7.2%.

- The German flag state, finally, barely retains the 5th European ranking, with a slight increase of 0.3% in 2022. But it is followed by the Czech Republic, which crossed the 35 billion tkm mark thanks to an increase of 3.1% last year.

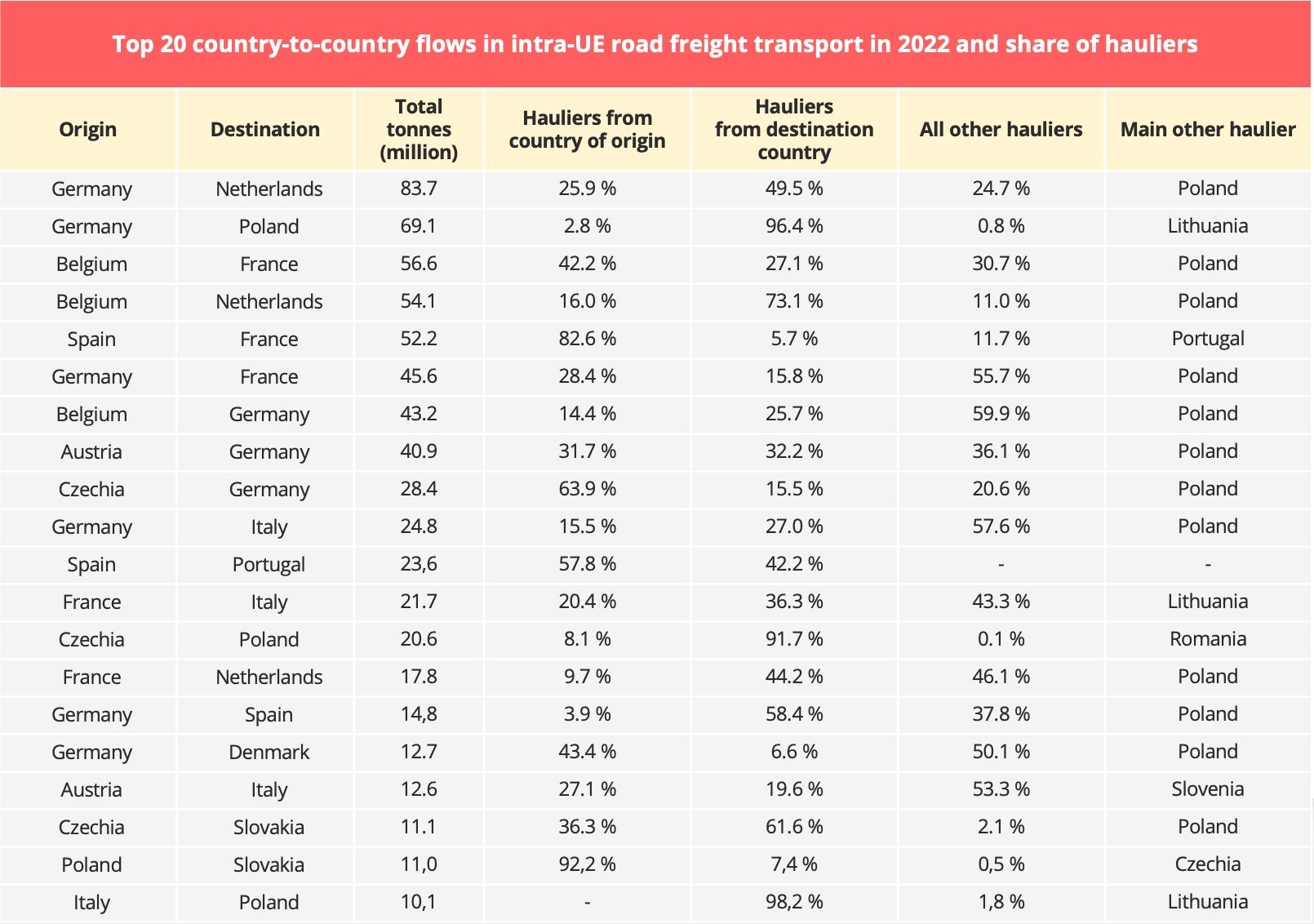

The importance of the German market

While the German fleet is losing ground, the analysis of the tonnages transported from country to country within the EU shows that the German market is, on the other hand, essential for international intra-European transport activity. "Germany was one of the origin or destination countries in almost half of the top 20 country-to-country flows in 2022, illustrating the central role of Germany in intra-EU trade flows. However, German hauliers’ share of the volumes transported was less than 50 % in all country-to-country flows in the Top 20, with as little as 2.8 % in 2022 in the traffic between Germany and Poland," summarises Eurostat.

Data source: Eurostat

The measurement of the market share held by carriers from Member States other than those of origin and destination also perfectly illustrates the dominance of the Polish flag and the rise of carriers from Eastern countries. "Among hauliers from Member States other than the origin and destination countries, Polish hauliers were by far the most common ones. Of the top 20 intra-EU country-to-country transport flows in 2022, Polish hauliers were the main transporters from and to other Member States for 12 connections. Of the remaining seven connections with ‘other hauliers’, Poland was origin or destination country in four".

For the moment, the introduction of the Mobility Package does not seem to have significantly disrupted the international activity of carriers from Eastern countries.

[1] National transport is is Road transport between two places (a place of loading and a place of unloading) located in the same country by a vehicle registered in that country

[2] International transport is Road transport between two places (a place of loading and a place of unloading) in two different countries and cabotage by road. It may involve transit through one or more additional country or countries.

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article