.gif?width=730&height=395&name=visuels-rs-market-insights%20(2).gif)

The trade war between Europe and the United States has reached a truce. But the road to a transatlantic trade agreement is still long.

On March 5th, the US and the EU agreed to mutually suspend for a four-month period the tariffs linked to their large civil aircraft trade dispute. Both parties hope to utilize this period to strike a transatlantic trade deal. This article first reviews the impact of the tariffs on transatlantic trade and will then briefly deal with the prospect of a transatlantic trade deal.

The impact of the Large Civil Aircraft Trade Dispute on trade

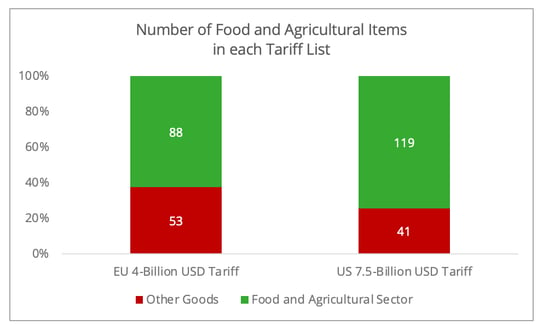

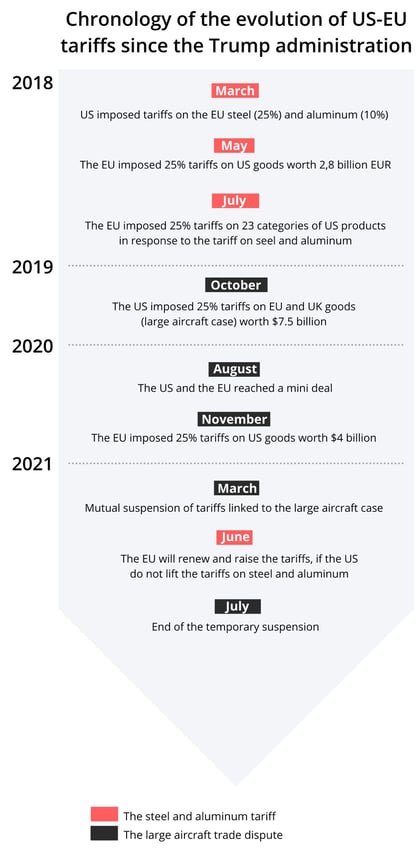

The tariffs associated with the large civil aircraft trade dispute are namely the EU’s 4-Billion USD tariff on US goods imposed from November 2020 and the US’s 7.5 billion USD tariff on EU and UK goods effective since October 2019. Besides the aircraft manufacturing industry, the most heavily targeted sector by both sides is the food and agricultural sector (Figure 1). The figure below illustrates the impact on trade in the alcohol industry as an example, as it is among those hit the hardest by the tariffs.

Figure 1 - Data source: the US Trade Representative and the EU Trade Commission

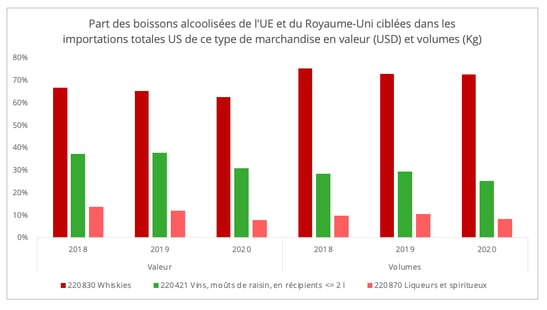

In the US’s 7.5 billion USD tariff, three types of alcoholic drinks, whiskey, wine, and liqueurs, are subjected to an additional 25% tariff. Comparing 2020 to 2018, the share of these three alcoholic beverages from the targeted EU countries and the UK in the US’s total imports has dropped on average 6% in value and 2% in volume (Figure 2).

Figure 2 – Data source: US Census Bureau

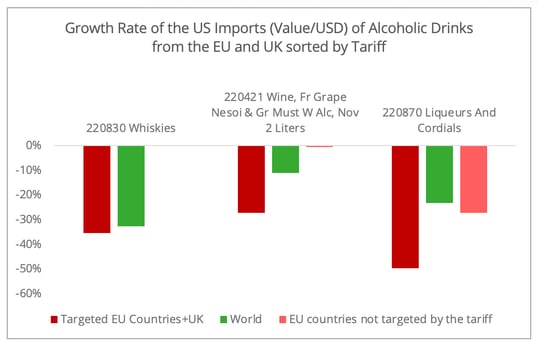

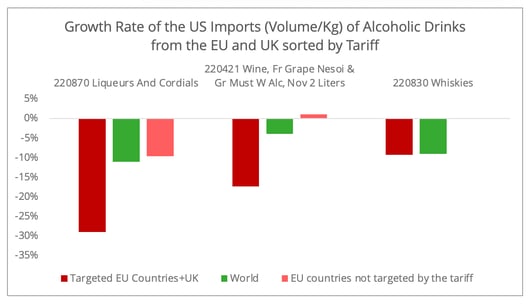

In terms of trade volumes, while the US’s total imports of the three targeted alcoholic drinks dropped in 2020 amid the pandemic, US demand from the targeted EU countries and the UK eroded more significantly (Figures 3&4). Apart from the tariffs, the mobility restriction measures and disrupted shipping amid the pandemic exacerbated the trade performance.

Meanwhile, there is a perceivable trade diversion to EU suppliers not targeted by the tariffs (Figures 3&4), for instance Portugal and Italy for wine, or South American countries, like Chile or Argentina, but also Oceania countries.

Figure 3&4 - Data source: US Census Bureau [1]

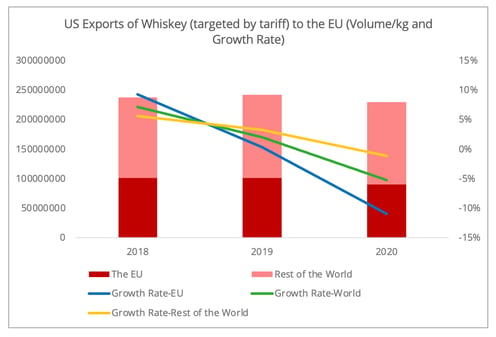

A similar impact can be anticipated for the exports of US rum to the EU, which is included in the EU’s 4-billion USD tariff list issued in November 2020 [2]. Due to the limited data concerning US rum, we will take US whiskey trade with the EU as a reference case. This product has been subjected to the EU’s 25% tariff since 2018 in response to the US tariff on EU steel and aluminum (see the chronology below).

From 2018 to 2020, the share of US whiskey in the EU’s imports shrank from 74% to 57%[3] in volume, and from 75% to 69% in value. In 2020, the volume of US exports of whiskey worldwide declined by 5% due to the pandemic, however, the exports to the EU contracted by 11% (Figure 5). According to the Kentucky Distillers’ Association, the exports of Kentucky Bourbon fell by 35%, with shipments to the EU dropping by nearly 50% due to the imposed tariff.

In contrast, the relatively modest decline of US whiskey exports to non-EU countries in 2020 (-1%) indicates a trade diversion to alternative markets. For instance, the US whiskey exports to Australia has enjoyed increases of 20% in volume and 16% in value in 2020.

Figure 5 - Data source: US Census Bureau [4]

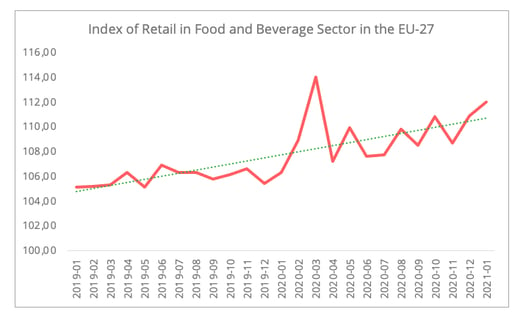

In light of the positive projection of retail in both the US and the EU, the mutual suspension of tariffs benefits the transatlantic food and beverage trade. For the US, the relatively high vaccination turnout and Biden’s 1,900 billion USD stimulation plan are likely to boost household consumption. According to the National Retail Federation, retail in the US in 2021 is projected to enjoy a 6,5% to 8,2% annual increase regardless of the stimulation plan. The EU is struggling with the emerging third wave of Covid-19. However, retail in the food and beverage sectors continues to perform strongly (Figure 6), despite the fact that the continued lockdown of restaurants and bars is affecting demand for alcoholic beverages.

Figure 6 – Data Source: Eurostat

Revitalization of the Transatlantic Relation

The suspension of tariffs signals a shared interest of the EU and the US in moving on from the turbulent transatlantic relations during the Trump Administration. The revitalization of the bilateral relation gives hope to the prospect of a transatlantic trade deal. However, some factors could hamper the outlook of such an agreement.

1/ The ambiguous attitude from the Biden Administration to the tariff on steel (25%) and aluminum (10%) from various countries, including the EU.

The removal of tariffs needs to be reciprocal. Yet, recent moves from the Biden Administration seem to indicate a preference for keeping the tariffs instead of lifting them (Figure 7). Not only were the tariffs considered “effective” by the Chief of Commerce for the Biden Administration, but the Administration has also reinstated the 10% tariff on the UAE aluminum, which Trump’s Administration lifted in January 2021.

Figure 7- The EU's measures on U.S. exports, in response to U.S. steel and aluminum tariffs, are worth a total of €6.4 billion. The first phase, which went into effect on June 22, 2018, represents a value of €2.8bn. Measures on the additional €3.6bn of exports could apply later, i.e., within three years or upon a successful conclusion of the WTO dispute, if sooner.

Though well received by various domestic steel manufacturers’ associations, the tariffs on the steel and aluminum could motivate the US manufacturing industry to offshore, instead of reshoring. The domestic steel supply insufficiency and the higher cost of imported steel may prompt the US downstream manufacturers to seek lower cost overseas options. This is also the case for other industries hit by the EU retaliatory tariffs. For instance, Harley Davison, in response to the EU 25% tariff on motorcycles has reconfigured its supply chain and moved parts of its manufacturing activity outside the US to offset the impact of the imposed tariff, especially since the EU is its second-largest market.

In a scenario of no mutual removal or suspension of tariffs on steel and aluminum, the EU will renew and further increase its tariff to 10-50% on listed US goods in June 2021. That is to say, some goods such as US whiskey and motorcycles will face a 50% tariff entering the EU market. This could reinforce the motivation of US manufacturers to offshore. As the renewal of EU tariffs will occur prior to the end of the four-month suspension (Figure 6), this issue could generate upheaval in transatlantic trade negotiations.

2/ The 100-day domestic supply chain security review ordered by the Biden Administration presents both opportunities and uncertainties to the transatlantic trade negotiations.

The supply chain security review will focus on some critical sectors, including semiconductors, critical minerals, pharmaceutical, and electric vehicles. On the one hand, the aim to reduce reliance on China is likely to generate new cooperation between the EU and the US. On the other hand, it is questionable whether the Biden Administration's coordinated approach suits the EU’s interests. Especially as those sectors listed in the review are also the ones the EU is trying to bring back home.

Inevitably, China will play a role in transatlantic trade negotiations. A transatlantic trade agreement also serves as part of Biden’s more coordinated approach to addressing the China issue. It is without doubt that the EU shares more in common with the Biden Administration’s approach to China than with that of the Trump Administration. However, there are also diverse voices within the EU on this topic. This pattern can be seen in regard to the mutual EU and Chinese sanctions. For instance, the way in which the ongoing EU-China Comprehensive Agreement on Investment is handled within the EU could also have a spillover effect on transatlantic relations.

Notes

- [1] The tariff on whiskey only applies to the UK. Hence, this does not include the data for "Targeted EU Countries + the UK".

- [2] The available data is only until January 2021, which is not sufficient to make an assessment.

- [3] Data is generated from the Eurostat, based on the trade data of HS code 22083011, 22083019,22083082, and 22083088, which are facing 25% tariff when entering the EU market since 2018.

- [4] The volume data (HS code 220830) only includes the vessel shipping data (kg)

Sources

- Kentucky Distillers' Association, Trade war slashs Kentucky Bourbon Exports by 35%

- National Retail Federation, NRF Forecasts Retail Sales to Exceed $4,33T in 2021 as Vaccine Rollout Expands

- Financial Post, Biden Commerce Chief Says Steel, Aluminum Tariffs "Effective"

- Reuters, Biden to keep tariffs on aluminum imports from UAE, reversing Trump

- Bloomberg, Wary Steelmakers Leave 'Giant Hole' in Biden's U.S. Factory Push

- Nbcnews, Harley-Davidson to move some production overseas to offset tariffs

- FRANCE 24: Western nations sanction China over rights abuses, prompting tit-for-tat response

- South China Morning Post: EU-China deal on the rocks as sanctions shake support in European Parliament

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article