INFOGRAPHICS. Registrations of medium and heavy commercial vehicles (+3.5 t) jumped by 15.7% in the European Union in 2023. Poland and Lithuania are the exceptions, with growth of less than 10%.

1/ European market

- Vehicles over 3.5 t

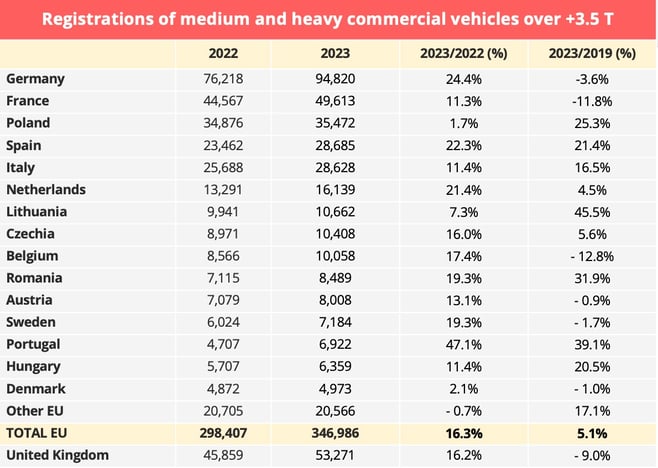

The growth trend in vehicle registrations of +3.5 tonnes observed in 2022 was amplified in 2023, with an increase of 16.3% in the European Union last year, compared to 3.5% the previous year. The market has thus risen sharply above the 300,000-registration mark, for the first time since 2019, and is even 5.1% above that last pre-pandemic reference year.

This counter-current rebound may come as a surprise, given that the economy entered a slowdown phase in 2023. This is partly due to the effect of the lead times between orders and deliveries. Indeed, in 2021-2022, supply chain disruptions caused by the Covid-19 pandemic led to shortages of raw materials and semiconductors that disrupted vehicle production. As a result, delivery lead times had been significantly lengthened and the situation only became normalised in 2023.

Content source : ACEA

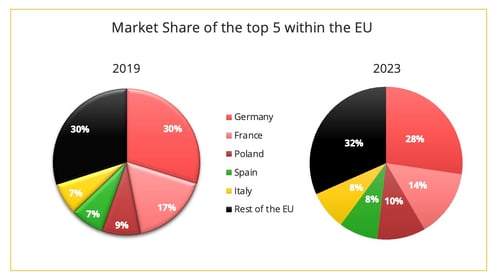

The top two markets, Germany and France, benefited from the overall rebound, unlike the leading European flag state in terms of traffic volume, namely Poland, which posted the lowest growth rate in the European Top 15. However, the five-year evolution figures tell a different story with an increase of 25.3% for Poland, while Germany and France remain below their 2019 levels. A similar trend can be observed in Lithuania, today's 9th biggest European flag state for road transport. Its growth in truck registrations was below the European average in 2023, but the country exceeded the 10,000-registration mark and holds the top spot for growth compared to 2019.

Spain and Italy, which complete the Top 5 European road freight flag states alongside Germany, France and Poland, both showed a significant increase in registrations, both year-on-year and compared to pre-pandemic levels.

Content source : ACEA

In 2023, diesel trucks continued to dominate the market by a wide margin, accounting for 95.7% of new truck registrations. Solid growth of 15.8% was recorded in diesel truck sales in the EU, driven by key markets, particularly those of Germany (+23.5%), Spain (+21.8%) and Italy (+12.3%). At the same time, new registrations of electric trucks reached 5,361 units, an increase of 234.1%. "The Netherlands (889.7%) and Germany (169.8%) were the main drivers of this remarkable growth, together contributing to more than 60% of electric truck sales in the EU," says the European Automobile Manufacturers' Association (ACEA). Electric trucks account for 1.5% of the market, up from 0.8% in the previous year.

- Vehicles over 16 t

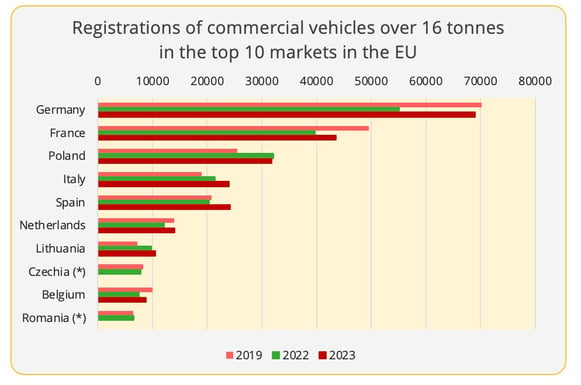

Vehicles over 16 tonnes accounted for 77% of truck registrations in 2023. With a total of 266,879 units the market showed a growth of 14.7%.

In the Top 5, Poland stands out with a drop in the number of registrations, whilst all other countries are progressing. Nevertheless, compared to 2019, Poland shows a clear increase, while the main two markets, Germany and France, are down.

(*) Data not available for 2023 - Data source: ACEA

2/ Focus on CEECs

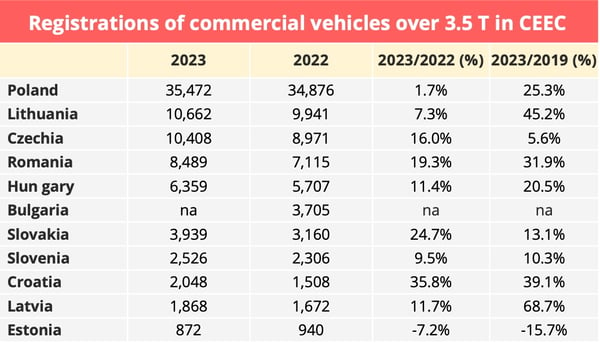

Data for the year 2023 show a contrasting situation for Central and Eastern European countries (CEECs), with a below-average increase for Poland and Lithuania. Nevertheless, compared to the last pre-pandemic year, there has been very strong progress in Lithuania, which has made road transport a focus for strategic development of its economy. Poland, Romania and Hungary also exceeded 20% growth. On the other hand, the increase in new vehicle registrations is less dynamic in the Czech Republic, even though this country ranks 7th in Europe among European flag-states in terms of traffic and 2nd among the CEECs.

na: non available - Content source: ACEA

3/ Focus on the French market

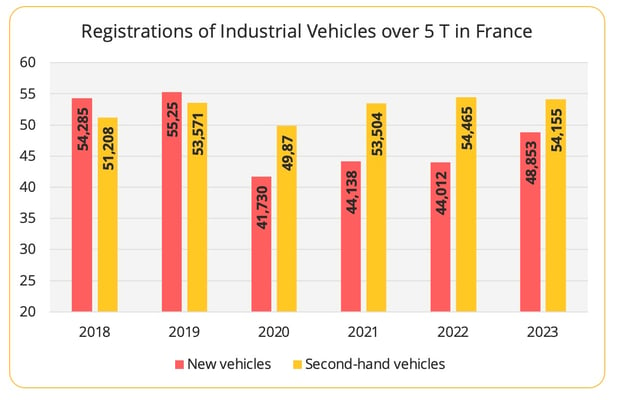

Commercial Vehicle registrations on the French market were marked by a clear rebound in 2023, even if France remains below the growth rates observed among the other main countries of Western Europe. With a total of 48,853 registrations, the market for new CVs of 5t or over grew by 11% in 2023 compared to the previous year, according to data from the CCFA (Committee of French Automobile Manufacturers).

The road tractor market grew by 11.8%, having already seen a similar increase in 2022. It thus amounts to 28,425 registrations. The rigid truck market, which fell by 11.4% in 2022, is on the rise again but has not yet returned to 2021 levels. It totalled 20,428 registrations in 2023, a growth of 7.7%.

At the same time, the used commercial vehicle market fell by 0.5%, with a total of 54,155 registrations.

Content source: CCFA

Content source: CCFA

According to the annual market study published by the BNP Paribas OVI (Commercial Vehicle Observatory), this momentum seen in the new vehicle market in 2023 is partly explained by a catch-up effect. "After the health crisis, shortages of electronic components had limited equipment deliveries. Orders were struggling to be honoured, which no longer seems to be the case". Indeed, according to data collected by the OVI, delivery lead times have been significantly reduced, from a peak of 359 days in June 2022 to 150 days in December 2023. The improvement in lead times, however, is not just due to the end of component shortages. It is also the result of a drop in orders. Over the year, the first eight months were particularly intense in terms of registrations with a monthly total in August 21.8% higher than in 2022. However, the market calmed down in the autumn.

The OVI is also quite pessimistic in its forecasts for 2024, announcing that on the +3.5t vehicle market there would be "a slowdown or even a contraction in registrations for 2024 that could reach -5%". The OVI experts also expect orders to fall by 11.9% on tractors and 11.7% on rigid trucks, which should have "a visible impact on registrations in the second half of the year due to the pronounced shortening of delivery lead times".

Source : OVI

Despite this unfavourable environment, new vehicle prices continue to rise. For tractors, the increase was 14.4% between 2021 and 2022, and distributors estimate it at 9.2% in 2023, which is more than a 20% increase in two years. For rigid trucks, the increase was 16.4% in 2022 and stood at 9.5% in 2023, says the OVI. These increases contribute to the drying up of order books, alongside the rise in credit rates and the sluggishness of the market.

Logically, investments by transport companies are therefore almost exclusively devoted to vehicle replacements. "Only 10.2% is to be used for the extension of fleets. This result, unchanged since last June, has been steadily declining since 202", notes the OVI.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article