We are continuing the analysis of Incoterms and their possible revision in 2020. This week, our expert shares his insight concerning Incoterms in C:

We’re still focused on showing that there are two separate categories of sales: “on departure” sales for the agreements following the E and F terms and “on arrival” sales for the agreements following the C and D terms.

For C and D agreements, the main shipping service is always the seller’s responsibility, and it is included in the export sales price.

The C letter Incoterms are called the “strategic” ones because of their role in the global economy. They let the loader control, negotiate, and include the shipping costs in the final sales price. When using a C, the loader controls and monitors most of “its” streams and can improve its sales price by adding a well negotiated shipping service to it.

It’s important to note that, as it was to be expected, China is very involved in the revision of this category of Intercom. This is no coincidence: most of the goods currently leaving the Chinese ports are doing so with FOB agreements. So, it’s the European and American importers who dominate with their dual role as loaders-receivers.

At this stage, let’s recap what the word loader means for maritime transport in international commerce: the loader is the one who chooses, and pays for the main shipping service.

It is easy to see why Chinese exporters, within the broader long-term framework of the Belt & Road Initiative, wish to gain a better control over their exports by using a type C international sales process. This is even truer for the support of Chinese dominated maritime alliances (especially for Ocean Alliance with CMA-CGM, COSCO,OOCL, and Evergreen).

This is a mostly underestimated strategic challenge, especially for the European and American retail industry, which may lose part of its control over its own stream of merchandise.

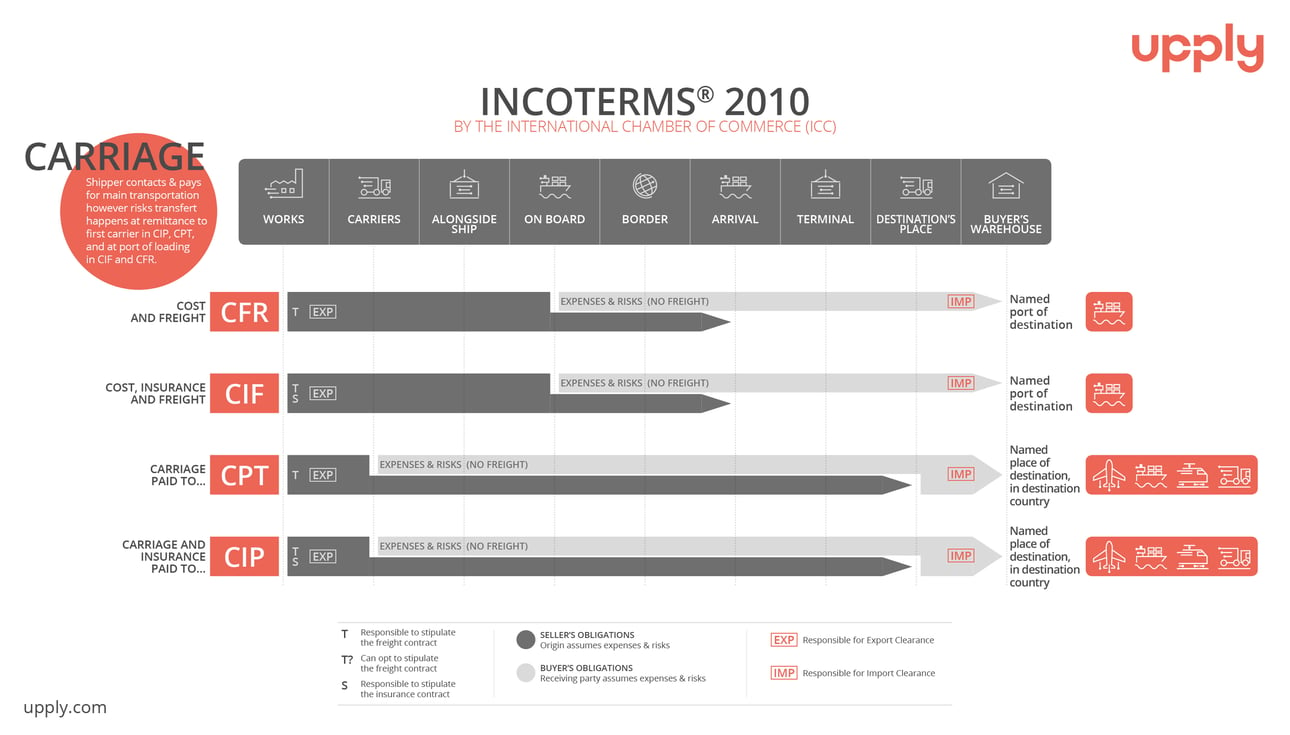

We can point out the traditional maritime Incoterms CFR and CIF (the seller purchases an insurance policy on behalf of the buyer) and their multimodal equivalents CPT and CIP.

China is very interested is having the CIF include the THC to the final destination (THCD) in this new version.

We can see the intention of bundling all of the handling services with the freight itself, which may give a strong competitive advantage to the Chinese maritime companies who would be able to align their Liner terms (general terms and conditions for the freight sales of containerized maritime companies) with this Incoterm to strengthen their grasp on the market.

Gate In Gate Out (GIGO) Freight rate that includes THCL and THCD (See Bench UPPLY Port-Port).

Free In Free Out ( FIFO ) Freight rate that excludes THCL and THCD

Gate in Free Out ( GIFO) Freight rate that includes THCL and excludes THCD

Free in Gate Out (FIGO) Freight rate that excludes THCL and includes THCD

Key points: CFR, CIF, CPT, CIP will remain, a new CNI multimodal Incoterm is being considered (Cost and insurance up to) to define the insurance conditions for CIP.

Strong pressure from China to have a CIF that offers an “at terminal” port of destination (rather than on board the vessel). The justification mirrors the FCA with regards to the FOB since the THC to final destination cannot be taken out. This CIF variation called CIF “LANDED” is already widely used, and in practice it means that all costs are covered by the seller until the container leaves the ship on a truck when it gets to the destination.

You can find the analysis of the E category and the F category. See you next week for the analysis of the last category, the D category.

Photo credit: ID 97453281 © Chutima Sonma | Dreamstime.com

Infography: xi-graphisme

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article