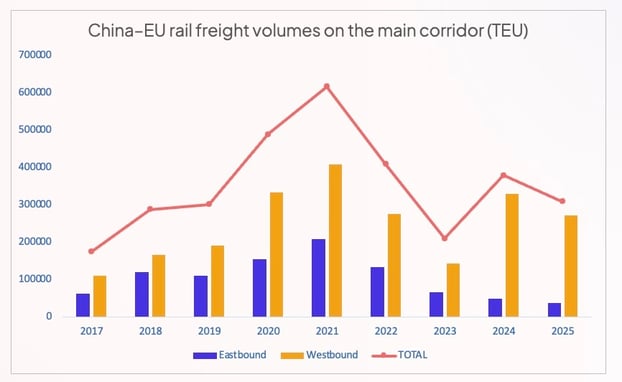

China to EU rail freight volumes via the Northern Corridor started to decline again in 2025 and are tending to become negligible in the other direction.

The improvement was short-lived. According to data from the operator European Rail Alliance, which concerns the Northern Corridor, rail freight volumes between China and the European Union fell again in 2025, after a rebound in 2024. They stand at 310,579 TEUs, a decrease of 14.1% compared to 2024.

The decline is evident in both directions, but it is particularly marked from Europe to China, where we can speak of a real collapse in two years. Traffic fell by 22.7% in 2025 after having already declined by 26.7% the previous year, recording its lowest historical level at 38,422 TEUs. In the China-Europe direction, traffic has also started to decline again, after a spectacular rebound in 2024. It amounted to 272,157 TEU in 2025, down 17.7% compared to the previous year.

Figure 1 - Data source: ERAI

A decline in competitiveness compared to maritime activities

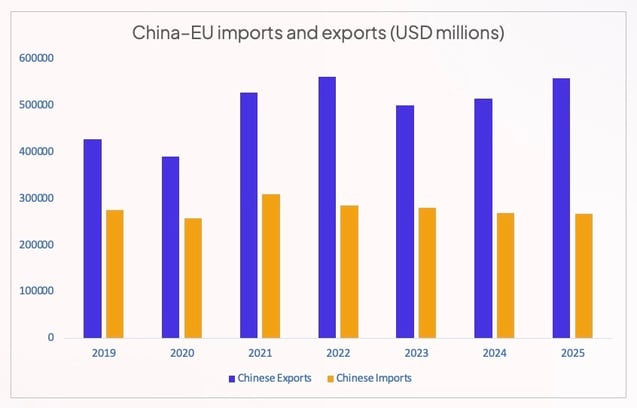

The decline in rail freight from China to Europe cannot be explained by the general evolution of the market. Indeed, China's exports to the European Union are doing rather well, having increased by 8.4% in value, reaching $560 billion.

Figure 2 - Data source: Chinese Customs

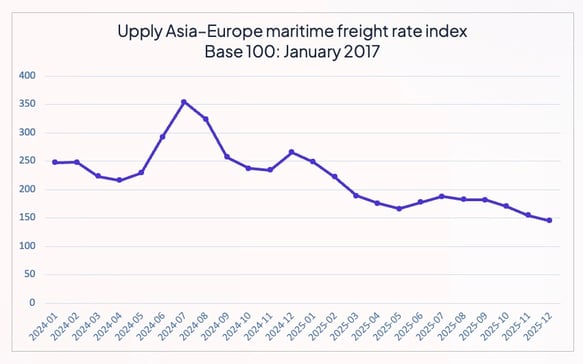

The decline in China-Europe rail freight in 2025 is partly explained by exceptional disruptions. In September, in particular, Poland decided to close its border with Belarus following the overflight of Russian drones, which paralysed road and rail traffic for several days. On the other hand, rail freight has suffered a loss of competitiveness compared to maritime transport. In 2024, maritime freight rates had started to rise again due to disruptions created by attacks by Houthi rebels from Yemen in the Red Sea. But the diversion via the Cape of Good Hope then became the norm, and when supply chains regained their fluidity, the pressure on freight rates lessened.

Figure 3 - Source : Upply Freight Index

In the Europe-China direction, rail is also not very competitive, as maritime freight rates have reached a particularly low level, and demand is clearly not there. In 2025, China's overall imports from Europe are expected to have decreased by a further 0.5% in value compared to 2024, coming in at $268.2 billion.

Characteristics of East-West rail traffic

- In 2025, the China-Poland route accounted for 94% of all China to Europe flows, compared to 88.6% in 2024. The volume on this corridor amounted to 255,869 TEUs, down 12.7% compared to the previous year.

- China-Germany rail traffic, after a slight rebound in 2024, has fallen sharply again, decreasing by 43% to 13,552 TEUs.

- On other destinations, the plunge is even more spectacular: -78% to 1,740 TEUs to Belgium, -56% to 888 TEUs to the Netherlands and -97% to 108 TEUs to Hungary. As volumes decrease, the logic of massification at the Polish hub prevails.

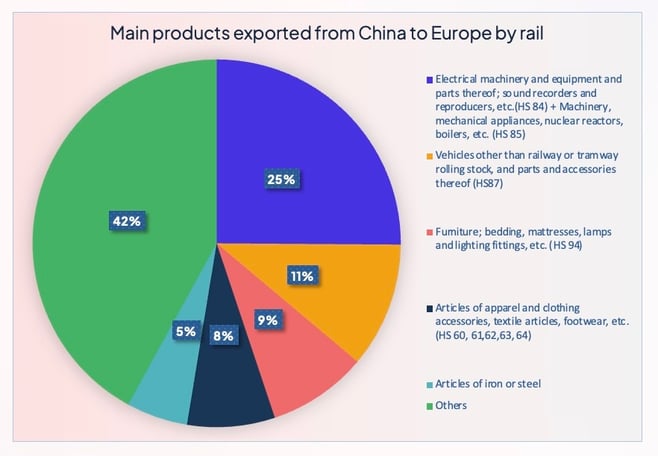

Figure 4 - Data source: ERAI

In the East-West direction, mechanical and electrical machinery and equipment (HS codes 84 and 85) dominate the market, but their share fell to 25% of total volumes in 2025, compared to 30% the previous year, if we combine the results of the two categories. The vehicle segment experienced a slight decline (4.1% to 30,010 TEU for products corresponding to HS code 87), but after a very strong increase the previous year. On the other hand, the furniture, bedding and lighting equipment sector (HS code 94) continues its growth, with an increase of 16.5% in 2025 (23,794 TEUs). It thus surpasses the clothing, textiles and footwear sector (HS codes 60, 61, 62, 63, 64), which fell by 32.6%.

Figure 5 - Data source: ERAI

Characteristics of East-West rail traffic

Since 2021, Chinese imports from the European Union have been inexorably declining. Rail traffic has always been very unbalanced, in favour of East-West flows, but the gap continues to widen. With only 38,422 TEUs transported in 2025, West-East traffic is down 22.7% and reached a historic low.

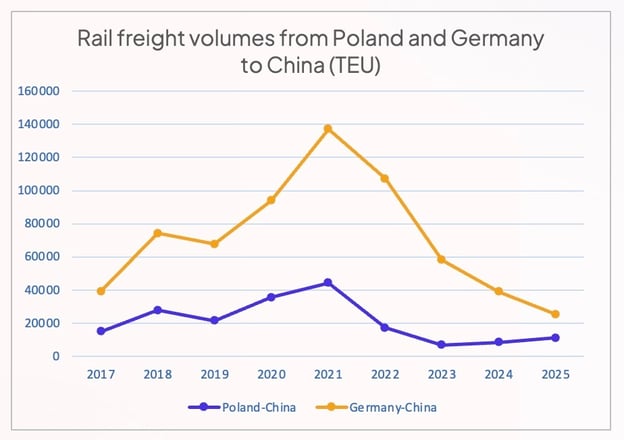

- Germany-China traffic accounts for 65% of total traffic, but has been experiencing continuous erosion since 2021. That year, the Covid crisis had led to difficulty accessing maritime capacity and a subsequent surge in its freight rates, making rail more attractive. In 2025, Germany-China flows fell by 25%, to 25,418 TEUs. As in 2024, German production was hit hard by the decline in Chinese imports, and this had repercussions on rail freight. The flows of vehicles and associated parts (HS code 87) collapsed, falling to 2,476 TEUs (-71%, after already falling by 41.7% in 2024). The mechanical machinery and equipment segment (HS code 85) also experienced a sharp decline.

- On the Poland-China route, however, flows recorded a second consecutive year of increase: +30% to 11,224 TEUs.

Figure 6 - Data source: ERAI

The decline in China-EU flows weighed on the overall results of the China Railway Express, which also include flows to Russia and to non-EU European countries. In 2025, transported volumes reached 2.05 million TEUs, down 1.3%. Traffic is more balanced when non-EU traffic is taken into account, as it amounted to 10.3 million TEUs (-10.1%) in the East-West direction and 10.2 million (+9.4%) in the opposite direction. The number of trains increased by 3.2%, totalling 20,022 trains, including 10,124 departing from China (+14.4%) and 9,898 in the other direction (-6.1%).

Outlook

Rail freight between China and Europe is expected to continue to evolve in a challenging environment in 2026.

Favourable factors

- Chinese exports are expected to continue to grow, boosted by very proactive Chinese policy in this area. This is a vital activity for the Chinese economy, and the restrictions imposed by the United States on access to their market will continue to further encourage the shift towards the European market.

- The development of Chinese e-commerce platforms and especially the evolution of their logistics patterns could generate new flows. Until now, these platforms have relied heavily on air freight, which makes no economic sense given the price at which the products are sold. They are now moving into phase 2 of market conquest by setting up warehouses near consumer hubs, like Shein which announced a pharaonic project in Poland. Rail freight could be a good cost/time compromise between air and sea freight to supply these logistics facilities.

Unfavourable factors

- While there are indeed factors that could stimulate growth, the weakness of the European economy will nevertheless remain a hindrance. Households and businesses are being very cautious, and demand will therefore remain moderate.

- On the other hand, the increase in exports will not necessarily benefit rail freight, which is expected to continue to suffer from a competitiveness differential with containerised maritime transport, unless an unforeseen event causes freight rates to skyrocket.

- Finally, rail freight is not spared from geopolitical uncertainties, as seen in 2025 with the closure of the Polish border.

In the West-East direction, the outlook is even bleaker. At this stage, there is no evidence to consider a future recovery. The reduction in Chinese imports from Europe, and in particular from Germany, even argues in favour of a continuation of the decline.

For China Railway Express, the drivers of growth are located primarily in Asia. In 2025, flows to Central Asia increased by 27.7% to 1.13 million TEUs, of which 701,399 TEUs in the East-West direction (+24.5%) and 425,585 TEUs in the other direction (+33.2%). The number of trains amounted to 14,254, up 9.6%, including 8,602 in the East-West direction (+17.4%) and 5,652 in the other direction (+23%).

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article