SPECIAL REPORT. After our presentation of the regional economy, our Road Freight Transport Tour de France stops for an update on market conditions. After falling back from 2013 to 2015, road freight transport on lorries of more than 3.5 tonnes returned to growth in the Hauts de France in 2016. Operators indicate, however, that the trend has been reversed in 2019.

In recent years, the Hauts de France road transport sector has clearly been shaken, as in the rest of France, by virulent foreign competition and "the increased use of vehicles of less than 3.5 tonnes as a means of avoiding legislation imposed on drivers of heavy goods vehicles such as that covering respect for rest time," as INSEE puts it in an economic report in June 2017. The sector has also suffered from the economic crisis and the effect it has had, notably on industrial activities. After falling from 2013 to 2015, however, road freight transport activity involving lorries of more than 3.5 tonnes returned to growth in 2016.

Three years of growth

"The turnaround was quite sudden, which engendered recruiting problems moreover. But the return to higher volume and the increase in turnover it brought with it had a positive impact on the finances of companies which was all the more positive for the fact that they had made a major effort to rationalise during the difficult years," said Olivier Arrigault, regional delegate of the Fédération Nationale des Transporteurs Routiers (FNTR).

In 2016 and 2017, the investment levels and profitability recorded at the end of the year were much higher in the end than those forecast in the opinion surveys carried out at the start of the year.

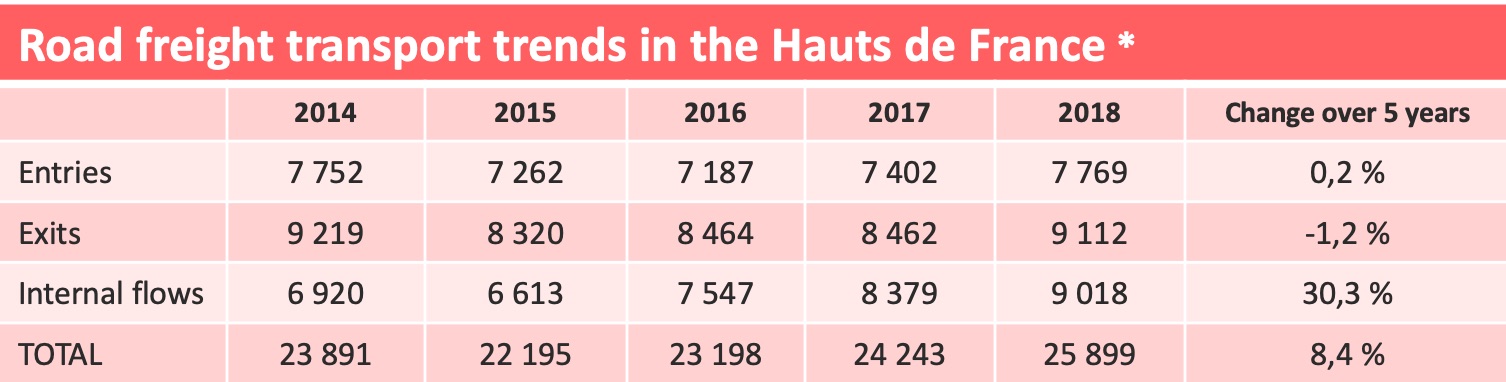

*in millions of tonne-kilometres transported - Source: SDES, road freight transport study

Road transport companies enjoyed three favourable years, although the scale and rhythm of growth varied considerably from one company and activity sector to another. "Trends are much less steady than in the past. You can have over the same period a sector which does well and another which is in great difficulty, which is why it is in companies' interests to diversify their activities as a means of dealing with these cycles," Arrigault pursued.

Vincent Verkebe, head of Transports Verbeke, a company which works, notably, with the major retailers, confirmed this observation. "We have seen a certain moroseness in the sector since the "yellow vest" crisis," he said. "The movement had a negative effect on consumption habits. Fortunately, we have other types of traffic flow, in agriculture, for example, where the organic sector in particular has been dynamic."

There is volatility, too, in business cycles which are increasingly short. "The opinion surveys we carry out at the start and at the end of the year reflect this. It is increasingly difficult for heads of companies to plan for the long term," Arrigault said.

Growth driven by internal flows

Growth in 2018 was clearly driven by internal traffic flows, which is to say those having their origin and destination in the region. These progressed 30% over five years to reach 9,018 million tonne-kilometres, according to provisional 2018 data in the latest regional economic report of the French national statistical institute INSEE. This result is markedly higher than the 23% average increase recorded over the country as a whole.

Results are a little less strong for flows in and out of the region coming to and from other metropolitan French regions (these figures do not include international trade or transit traffic). Incoming flows just managed to reach their 2014 level and outgoing flows were again slightly down. The good news, however, was that growth accelerated last year, showing increases of 5% and 7.5% respectively. "These increases reflect the dynamism of the region's logistics sector, whether for traditional mail order or for the major online operators," INSEE noted.

Traffic flows also benefited from industrial recovery in the Hauts de France after a long period of convalescence after the 2008 crisis. This contributed to French domestic traffic flows and international trade.

Great caution over 2019 outlook

During the second trimester of 2018, however, reasons for vigilance began to appear following an increase in fuel prices. "The regional survey we carried out with the Bank of France showed a diminution of profitability in 2018 which is not linked to any fall in turnover," said Olivier Arrigault. "The problem is indeed the result of a deterioration in the sale price/production cost ratio. Even though there is an indexation clause, there is always a time lag at the very least. In addition, this trend has produced some pressure on rates. Shippers are tending to organise fresh tender calls so as to wipe the slate clean and start again on a fresh basis."

Once again, the turnaround is not being experienced the same way by everyone. Transports Bray, for example, is continuing to enjoy growth. "We are very diversified," said David Bray, head of the company, " which allows us to compensate for spikes and seasonal effects. In addition, many shippers are starting to understand that they need to work with a win-win approach, particularly in a "zero stock" context. Quality of service makes the difference and the "Made in France" argument is starting to find an echo. Our margins nevertheless are still too low by comparison with our responsibilities and the changes in fiscal and social regulations on the way. We are being very cautious in our development forecasts because the market could turn around rapidly if there is a new crisis."

This state of permanent fragility results at best in a wait-and-see approach. The opinion survey carried out by the chamber of commerce and industry in November and December 2018 among a sample of 4,000 companies in different economic sectors indicated that business projections were cautious about 2019. In industry, it expected a a good level to be maintained in the automobile and intermediate goods sectors. There were good prospects, too, in inter-company trading. On the other hand, it was pessimistic about retail trading…and the transport and logistics sector.

Whatever criteria were adopted, the balance of opinion among heads of transport and logistics companies pointed downwards (-12% for profitability and liquidity and -6 points for turnover). The chamber noted nevertheless that there was "a more positive balance of opinion for the logistics sector as opposed to transport".

A tense post-holiday return

Throughout 2018, the clouds continued to gather and the transport sector was clearly affected. "We had the "yellow vest" movement from November on, snowfalls during the winter which led to lorries being taken off the roads, then the customs strike in March as the first Brexit deadline approached," said Stéphana Callari, secretary general of the Organisation des Transporteurs Routiers Européens (OTRE). "Overall, business activity is fluctuating strongly and is relatively weak compared to previous years."

Economic uncertainty apart, the Brexit saga is still on the agenda. But, with just a few weeks to go to the deadline, industry players are still in the same state of uncertainty as they were in the first half. "International traffic is ultimately of little concern to our regional companies since they are 90% operated by foreign companies which are neither French not British," said Arrigault. "On the other hand, the impact could be felt essentially in the agri-food and automobile sectors, where many sub-contractors and logistics businesses are established to serve production sites in the United Kingdom. In the end, uncertainty is never favourable for the economy."

To top it all, French government plans in the fiscal domain are going to stir up a hornet's nest. "The very uncertain national outlook, if it is confirmed, will have an impact on cashflow and results in 2019 and, even more so, in 2020," the FNTR representative said.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article