SPECIAL FEATURE ITALY 2/5. The Italian road haulage market has performed mostly above the European average in recent years, despite glaring infrastructure shortcomings.

In 2022, the Italian road freight transport market passed the one billion tonne mark, which had not occurred since 2013, thanks to a growth of 6.1% compared to the previous year. During the same period, the overall European market decreased by 0.5 to 13.6 billion tonnes. The Italian market is now in 5th place in Europe with 1,047 million tonnes (Mt), behind Germany (3,061 Mt), France (1,631 Mt), Poland (1,600 Mt), and Spain (1,588 Mt).

The domestic market accounts for 97% of tonnages. In addition, road freight transport accounts for about 85% of total inland transport flows in Italy. The remainder is mainly by rail, as Italian geography does not lend itself well to river transport. A notable fact in regard to cross-border transport highlighted by a study by the Directorate-General of French Treasury: "the share of rail transport on the Franco-Italian trade route is small (9%) compared to the Italian-Swiss (66%) and Italian-Austrian (30%) trade routes".

According to an estimate by Mordor Intelligence, the size of the road freight transport market in Italy is estimated at USD 38.40 billion in 2024, and it is expected to climb to USD 47.38 billion in 2030.

A dynamic flag state

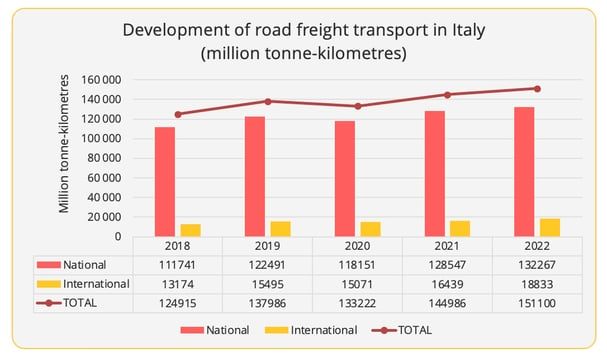

In recent years, transport under the Italian flag has performed very well compared to the European average. The country quickly recovered from the 2020 Covid-19 pandemic slump. With a total of 151.1 billion tonne-kilometres carried, transport under the Italian flag showed a growth of 4.2% in 2022 compared to the previous year, which was the highest increase in the Top 10. In 5 years, the cumulated increase reached 21%, which is also one of the best performances. Italy thus consolidated its 5th place in the European rankings.

The domestic market remains largely dominant, accounting for 87.5% of the tonne-kilometres handled by Italian carriers. In 2022, it posted an annual increase of 2.9% and 18.4% over 5 years. However, the Italian flag is also distinguished by a significant increase internationally: 14.6% in 2022 and 43% over 5 years.

The year 2024, however, does not present itself under such favourable conditions, in particular because of the deteriorating economic forecasts on a global and European scale.

Content source : Eurostat

Characteristics of the Italian Road Freight Transport

- A sector that continues to be very fragmented

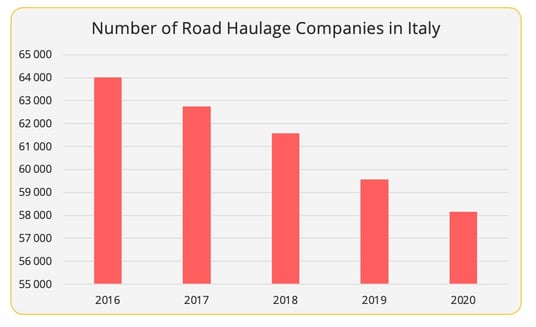

According to Eurostat data, Italy counted around 58,000 road freight transport companies in 2020, compared to 64,000 five years earlier. " Of these companies, a very large majority are very small, between 1 and 3 vehicles. Referred to as "padroncini", the owner-drivers have long been the symbol of the Italian RFT", specifies a study by the French National Road Committee (CNR) published in October 2023.The overall turnover of the sector is estimated at €40 billion per year.

Content source : Eurostat

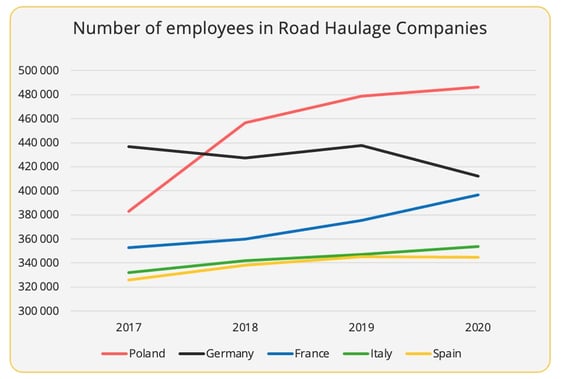

The structure of companies is now changing, which is a welcome development for the Transport Observatory of the Confcommercio (Confederation of Italian Commerce), in a study from November 2023. "The padroncini are still numerous, but these companies are less small and more efficient than before," says the trade confederation, while acknowledging that it is quite difficult to closely monitor their evolution. An indicator, however, exists, according to the study by Confcommercio, the number of joint-stock companies in road freight transport increased by 4,000 between 2018 and 2023, from 22% to 30.2% of the total road freight transport companies. The sector employed about 350,000 people in 2020, compared to 319,000 in 2016.

Content source : Eurostat

- An ageing fleet

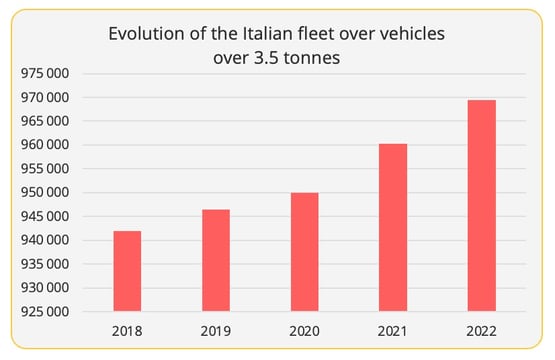

Content source: ACEA

According to the latest report by the European Automobile Manufacturers Association (ACEA) concerning vehicles in circulation in Europe, the Italian truck fleet stood at 969,488 vehicles in 2023 (+1% compared to 2022).The average age of Italian heavy goods vehicles in circulation is high since it is 19.1 years, compared to a European average of 13.9 years. Another worrying fact, which is not unrelated to the average age of vehicles: 98.2% of vehicles run on diesel, compared to an average of 96% in the European Union.

In 2023, however, the market for new HGV registrations turned out to be buoyant. According to data published by the Industrial Vehicle Market Observatory of the UNRAE (Association of foreign car makers operating in Italy), registrations of industrial vehicles of +3.5 tons increased by 12.2% compared to 2022, with a total of 28,707 units. The +16-tonne market represents the bulk of registrations with 24,479 units, up 12.6%, compared to 3,446 registrations in the 6-16-tonne segment (+15.8%), and 782 registrations in the 3.5-6T segment (-11.1%). The activity was favoured by the buoyancy of the Italian road transport market, but we can also see, as everywhere else in Europe, a catch-up effect, after the shortages of semiconductors that slowed deliveries in the previous two years.

Failing infrastructure network is penalising traffic

To improve its competitiveness and sustainability, the sector will have to face a series of important challenges, starting with that of infrastructure, which is in a particularly critical state in Italy.

The country has a road network composed of about 7,000 kilometres of motorways and 26,000 km of national roads, operated mainly by Azienda nazionale autonoma delle strade (ANAS), the public operator of the national road network.The network of the group Autostrade per l'Italia (Aspi), concentrated in the North, is comprised of 3,400 km of roads. The Italian motorway network is the 6th most extensive network in Europe and the 12th in the world.

A study on infrastructure published by Svimez, the Association for Infrastructure Development in the Mezzogiorno region, however, notes its underdevelopment in Italy, especially in the south of the country. The motorway network there represents 1.87 km per 100 km compared to 3.29 km in the north and 2.23 km in the centre. For Pasquale Russo, president of Conftrasporto, the confederation of carriers, "these data demonstrate the urgency of the implementation of an infrastructure investment plan as soon as possible to bridge the gap between north and south ".

Most of the roads were built between the 1960s and 1980s. It is true that the network coverage of the whole territory is "difficult and expensive", due to the topographical constraints that are the mountains and the peninsular character of the country: "70% of European road tunnels over 500m long are in Italy and the cost per kilometre of building a motorway is 1.5 times higher than in France", says a note from the French Treasury Directorate General. The ageing infrastructure, a source of congestion, poses a risk to the competitiveness of Italian road freight transport, on top of the problems it poses to safety. On this last point, the collapse of the Genoa bridge in 2018, the management of which was entrusted to the Atlantia group, served as a wake-up call.

Ambitious programmes are underway, particularly for the motorway network. On February 15, 2024, the European Investment Bank announced a loan of €1.2 billion to ASPI, to modernise, but also "make safer and more resilient in the face of future extreme weather events" the network managed by the operator. But much remains to be done on the national network as on the secondary network. On the eve of the coronavirus pandemic, two reports had already raised the issue of failing infrastructure. The first, drawn up by the Union of Italian Provinces, stated that 2,000 bridges and viaducts were at risk of collapse due to high traffic density and lack of maintenance. The second, commissioned by the government, estimated that 1,425 viaducts were abandoned, with no operator in charge of maintaining these structures. In October 2019, Brussels asked the Italian government to force concessionaires to return the network to good order by 2022, threatening to open infringement proceedings. According to the European Commission, this was a reasonable delay, Italian operators, however, considered that it was not long enough, as they have to overhaul almost the entire transalpine motorway framework. The case is still in progress.

The Road Safety Plan drafted by the Ministry of Infrastructure is accompanied by a budget of €450 million from the National Fund in addition to the Italian National Recovery and Resilience Plan (NRRP). The objective of this programme is to upgrade the bridges and galleries of the obsolete Italian road and motorway network, particularly in regions at risk of earthquakes such as Abruzzo, for example. The first stage provides for the identification of the 12,000 road infrastructures of the internal network. This operation should make it possible to draw up an inventory, which has never been done, and to assess the number of bridges, viaducts, walkways, galleries as well as their state of repair, which is often defective .

Challenges facing the Italian Road Freight Transport

- Driver shortages

Like its European and American counterparts, Italy is facing a shortage of truck drivers. According to the Confederation of Transporters (Conftrasporto), some 20,000 job vacancies are yet to be filled. To give a boost to the profession, the confederation proposed to drop the age of heavy goods vehicle licences to 18 and to review the regulations to promote access to the profession for nationals outside the European Union, in particular for drivers who have already been trained abroad. In Italy, young people at the age of 18 can obtain C or CE licences and the certificate of professional competence and drive a truck without a GVW limit, provided that they enrol in a driving school to take a 280-hour course including 260 hours of theoretical learning and 20 hours of driving practice. Another solution, for those over 20, is to take an accelerated training course with 130 hours of theoretical instruction and 10 hours of practice. However, those under 21 cannot drive a vehicle with a GVWR of more than 7.5 tonnes (unless they have taken the 280-hour course and have the licence and certificate). To encourage vocations, the government of Mario Draghi had released an envelope of €25.3 million for the period 2022-2026 in order to contribute to the costs of obtaining the driving licence and the certificate of professional competence to the tune of €2,500 per person, the equivalent of 80% of the total costs. An important but probably insufficient measure to stem the chronic lack of manpower , according to the sector associations. "Unfortunately, the profession of truck driver is no longer seen as attractive, we are facing a real vocational crisis, working conditions, the quality of life of drivers who work on public holidays and sleep at night in motorway parking lots are scaring away young people", says Amedeo Genedani, former president of Unatras, the Italian Union of Carriers.

- Increasing costs

According to a study made by the French National Road Committee (CNR) in October 2023, the mileage cost of an Italian heavy goods vehicle of 40 tons operating internationally amounted to €1.165 in 2021 against €1.12 in 2017, an increase of 4%. "This increase is largely explained by an increase in the costs relating to the driver and the cost of owning vehicles (+8.5%) due to the renewal of the fleet," says the CNR. The full cost, including structural costs, was estimated at €1.32 per kilometre at the end of 2021.

- Decarbonisation

In June 2023, the Italian Ministry of Environment and Energy Security presented a new Integrated National Energy and Climate Plan (PNIEC), which aims to accelerate the energy transition to comply with European objectives. In a note published in October 2023, the association Transport & Environment nevertheless considers this plan still insufficient, especially in the road transport sector. Most of the association's criticism relates to developments in the private car market, but some also apply to road freight transport. Overall, Transport & Environment believes that the Italian government is relying too much on bioenergy to meet its renewable energy targets in transport. It invites it to “ support the uptake of electric trucks by introducing a target share of the fleet for electric trucks to give a clear signal to industry”, and by granting aid for the deployment of public charging points for electric trucks in urban centres and along major roads. It also considers that "the existing aid for the renewal of HDV fleets of logistic companies, should not incentivise CNG, LNG and methane-fuelled vehicles".

Transport & Environment, on the other hand, welcomes the financial support for the modal shift of freight transport from road to rail (Ferrobonus) and from road to sea (Marebonus), but calls on the government to secure the budget and especially the continuity and certainty of the measure, which for the moment is only guaranteed until 2026, since the logistics sector needs long-term visibility to engage.

Our latest articles

-

Subscriber 2 min 10/03/2026Lire l'article -

Freight transport: the impact of military strikes in Iran

Lire l'article -

Heavy goods vehicle registration figures for 2025

Lire l'article