SPECIAL FEATURE 3/5. Road freight transport (RFT) accounts for almost three quarters of the total goods transported by land in Germany, and this share is expected to increase in the coming years. A pie that attracts competitors of the German flagged companies.

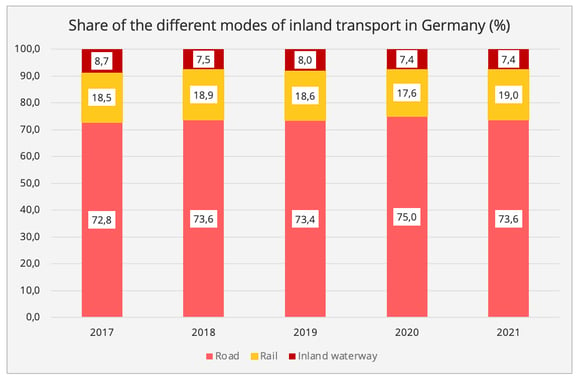

As elsewhere in Europe, road transport occupies a prominent place in the inland transport of goods in Germany. In 2021, it accounted for 73.6% of flows by land, a relative proportion that has been stable for several years (Figure 1). This is about 4 percentage points lower than for the European Union as a whole (77.3%), while rail and inland waterway traffic in Germany sit 2 percentage points higher than the European average.

Figure 1 - Data source: Eurostat

1/ A German flag in decline

As Europe's leading economic power and 4th largest in the world, Germany generates significant flows of goods. The total volume of goods transported in 2021 amounted to 3,108 million tonnes, which clearly makes Germany the leading European market, despite a slight decline of 0.4% compared to 2020. It sits ahead of France (1,649 Mt), Spain (1,626 Mt), Poland (1,581 Mt) and Italy (987 Mt).

Road freight transport activity totalled 307.3 billion tonne-kilometres (Figure 2), or 16% of the total in the European Union (EU 27). This represents a growth of 0.9% compared to the previous year, which was marked by the Covid-19 pandemic. But the recovery is much lower than that of the EU27 (+6.5%). In addition, among the top 10 European flags, Germany is the only one to record a decline in traffic over the period 2017-2021 (-1.9%). German flagged companies still occupy a strong position, ranking 2nd in Europe, but it is now well behind its Polish neighbour.

Figure 2 - Data source: Eurostat

- Thanks to the importance of its domestic market, Germany very clearly retains the number 1 European spot in terms of national traffic, despite a virtual stagnation for 5 years. It accounts for 23% of European domestic traffic in tonne-kilometres.

- In contrast, like many Western European flags, Germany was heavily challenged by Eastern European Countries from 2004 onwards, when eight countries of the former communist bloc joined the European Union. Today, in the European Top 5 in terms of international road traffic, there are three Flag states from the Eastern European Countries: Poland, very clear leader ahead of Spain with a total of 245 billion tonne-kilometres (BTKM) in 2021, Lithuania in 3rd position (54 BTKM) and Romania (41 BTKM) in 4th place. Germany is in 5th place, with 35 BTKM, a drop of 14.6% compared to 2017. During the same period, Poland grew by 14% and Lithuania by 50%.

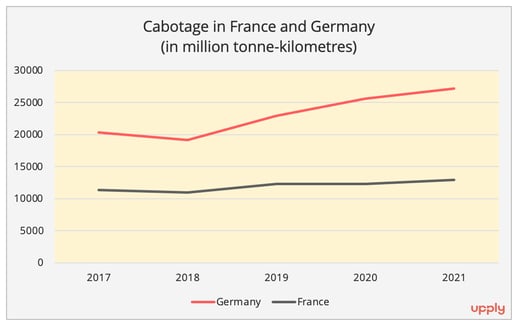

The German domestic market is extremely popular with carriers from neighbouring countries. Germany is, along with France, the country most affected by foreign cabotage, and this phenomenon continues to grow. There was an increase here of 33.5% over 5 years, against an increase of 13.8% in France where foreign cabotage is also very active (Figure 3).

Figure 3 - Data source: Eurostat

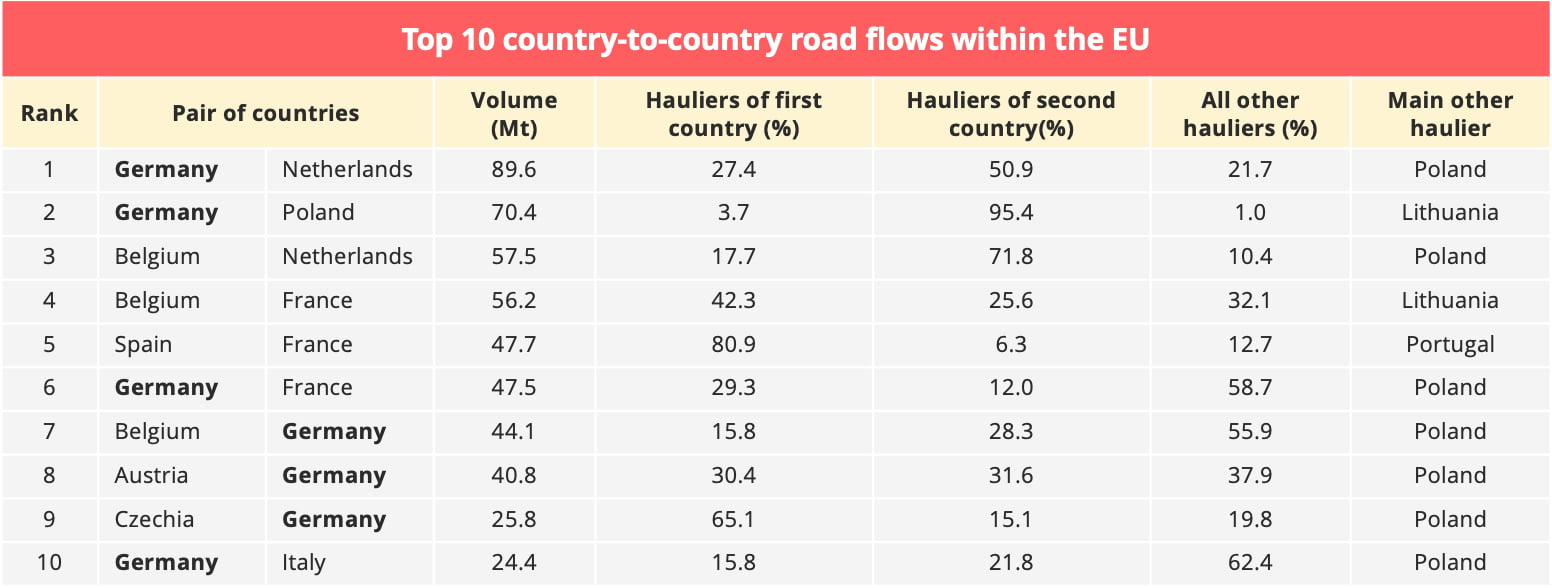

Economically speaking, the enlargement of the EU was not without interest for Germany, as it strengthened its central role in intra-EU trade flows. However, German road carriers have not benefited from this. In 2021, in the Top 10 of main road flows from one country to another, 7 originate in or are destined for Germany. However, "the share of German carriers in the volumes transported was less than 50% in all country-to-country flows", Eurostat points out. In some cases, the percentage of flows captured by German carriers amounts to quite paltry figures: 3.7% to Poland or 2.9% to Spain, for example (Figure 4). Outside the EU, Germany's main road flows concern Switzerland (17.2 Mt) and the United Kingdom (3.5 Mt).

Figure 4 - Data source: Eurostat

2/ The characteristics of German RFT

Germany now has about 35,000 road freight companies, a figure that has been fairly stable over the past five years. According to Eurostat data, the sector's annual turnover reached €46 billion in 2020, a year marked by Covid-19. Previously, the activity experienced continuous growth, reaching a peak of €46.3 billion in 2019 (+7.7% compared to 2018 and +14.9% in 5 years).

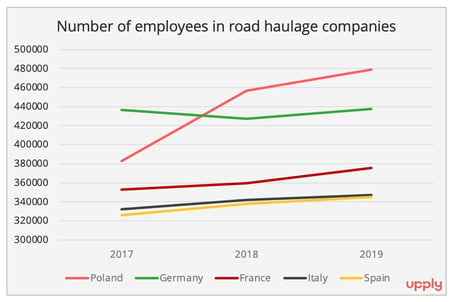

Road freight transport employs about 430,000 people (Figure 5). Germany has an average workforce of 11.6 people per company, almost twice the European average. The market is notably much less fragmented than in Spain, the European country which holds the record in this field.

Figure 5 - Data source: Eurostat (NACE H4941)

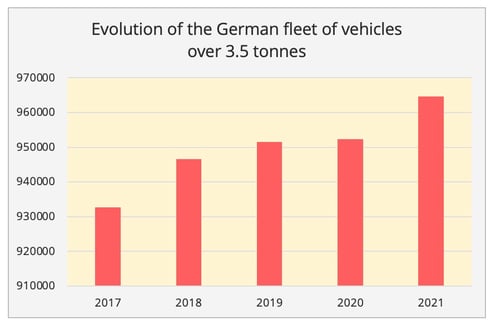

The latest report of the European Automobile Manufacturers Association (ACEA) on vehicles in circulation in Europe[1] sets the German fleet of vehicles over 3.5 tonnes in 2021 at 964,696. This represents a growth of 1.3% compared to the previous year and 3.4% over five years. At a European level the German fleet stands behind that of Poland, which totals 1.2 million vehicles, an increase of 4.2% year-on-year and 15% over 5 years. In total, more than 6.2 million medium and heavy commercial vehicles are on EU roads.

Figure 6 - Data source : ACEA

The German fleet also stands out for its newness, with an average vehicle age of 9.7 years, compared to 14.2 years on a European scale. Among the main markets, only France does better with an average of 9.2 years. However, truck registrations in Germany are trending downwards, with a 19.3% drop between 2018 and 2022.

3/ Strong growth in road transport expected by 2050

Like most European countries, Germany has ambitions for a modal shift. However, the latest forecasts from the German Ministry of Transport[2], published in early March 2023, do not argue in favour of such a trend.

- An increase in the modal share of road transport

Overall, freight transport, in volume, will increase by 30% between 2019 and 2051. This represents an average annual growth of 0.8%, compared to 1.8% during the period 2010-2019. The increase in tonne-kilometres will be greater, reaching 46%. In total, 5.7 billion tonnes and 990 BTKM will be moved on the German infrastructure network in 2051, compared to 4.4 billion tonnes and 679 BTKM in 2019.

According to the ministry's forecasts, most of the growth will be captured by road. “With a growth of 34%, road traffic volumes will grow significantly more dynamically than rail (+14%) and waterway (-10%), so that the share of road will increase from 86% of traffic volume in 2019 to 89% in 2051. In terms of tonne-km, the share of road transport will even increase by 4 percentage points, from 73% in 2019 to nearly 78% in 2051. Indeed, road transport, expressed in tonne-km, is expected to grow by 54%, against a 33% increase for rail and a stagnation for waterways. This is based on an increase in the average transport distance from 156 km in 2019 to 174 km in 2051.

- A structural change in the nature of the goods transported

The increase in the share of road transport is largely explained by a structural change in the nature of the goods transported. Due to the energy transition in Germany, the Ministry of Transport anticipates a sharp decline in bulk goods and energy products (coal, coke, petroleum products, ores, etc.). However, these goods were mainly transported by rail and waterway.

Conversely, strong growth in flows is expected for goods traditionally carried by road transport such as parcels (+200%), grouping (+91%), retail goods, in particular food and luxury goods (+29%) or vehicles (+47%).

4/ Challenges ahead

BGL, the German road transport federation, relied on these updated forecasts to alert the public authorities. "Trucks will still have to bear the main burden of freight transport in Germany at least until the middle of the century, as bulk goods that use rail, such as coal, will be marginalised as a result of climate policy decisions, and e-commerce, which uses trucks, will continue to grow strongly under the influence of consumer behaviour. These traffic forecasts must finally serve as a wakeup call for those who are holding back in the federal government!" said Dirk Engelhardt, BGL spokesman, welcoming the pragmatism of the Minister of Transport, Volker Wissing, who announced that he wanted to "base his transport policy on realities, figures, data and facts, and not on political wishes".

- Infrastructure development

To avoid a thrombosis of traffic, it is urgent to develop all modes of transport - including road, hammered home the minister. An ambition that requires infrastructure improvement. Every 10 to 15 years, Germany adopts a federal infrastructure plan to set the broad guidelines. The latest plan, adopted in 2016, provides for a total investment of nearly 270 billion euros, of which 49% is for road, 42% for rail and the remainder for waterways. One of the characteristics of this plan, which differs to the previous one dating back to 2003, is to focus on the maintenance and improvement of the existing network since the amounts allocated for this have increased from 56% to 69% of the total.

Investments are regularly debated in the German Parliament, in order to adjust them to demand and political priorities. This year, these debates took place in a political context marked by growing tensions within the German coalition government. At the end of March, after intense negotiations, an agreement was finally reached for the implementation of a new transport modernisation plan. The government has accepted a new doctrine of using motorway tolls to finance rail infrastructure. On the other hand, the Greens had to accept in return an acceleration of the planning and approval processes for all major infrastructure projects that concern not only the railways but also road transport.

The plan calls for a greater focus on the maintenance and renovation of roads and bridges, and the tackling of black spots in the federal highway system: 144 projects have been listed. "The arguments in favour of the extension of motorways, that is to say the elimination of bottlenecks, have prevailed", said the Minister of Transport. Very busy motorways are expected to be among the first to benefit from the acceleration of procedures, particularly in the Rhine-Main, Ruhr, regions, and the agglomeration of Munich. A total of 988 km of new roads will be built, which corresponds to 7.5% of the existing network.

- Energy transition

Germany is also facing the enormous challenge of energy transition. Reducing greenhouse gas emissions to 85 million tonnes by 2030, inscribed in the German government's climate protection law for the transport sector, requires massive efforts in the road transport of both people and goods.

In a document published in November 2022[3], eight professional associations representing the various actors involved in this energy transition highlighted a double necessity to achieve the objectives set: adapt the regulatory framework and accelerate the deployment of charging infrastructure. "If sufficient alternative energy capacity is available, battery technology can rapidly exploit significant potential reductions in CO2 (…) This propulsion technology could be one of the important pillars of CO2-free road transport, alongside hydrogen, gas and synthetic fuel propulsion", the authors point out.

The movement is already well underway in light commercial vehicles, which do not face the same autonomy issues. On the other hand, to stimulate investment in the heavy vehicle segment, players are calling for more visibility in public policies and support. And for the moment, if we are to believe some professionals, the expected results are just not being seen. The introduction of a CO2 tax on tolls and the extension of Lkw-Maut (HGV toll) to all vehicles over 3.5 tonnes, scheduled from 1st January 2024, is going down very badly. The pill is all the more difficult to swallow since the extension of the European Union Emissions Trading System to include road transport is already taking place. "The sector is still suffering from the Covid crisis, supply chain disruption, rising energy prices and high inflation. For the moment, there should be no further cost increases", Josef Dischner told the German parliament. In his opinion, the increase in tolls is seen as being solely punitive and not an incentive, insofar as alternative offers are not yet available. Electric trucks, which have only 10 to 15% of the range of a diesel truck, are not able to ensure the transport carried out by his company.

The adoption of "Charging Infrastructure Masterplan II", last October, is welcomed by professional associations. This plan focuses in particular on the development of charging infrastructures for heavy vehicles along motorways and in commercial premises. However, industry players expect "concrete objectives and more ambitious target dates".

- Shortage of drivers

Germany is facing another major challenge, which also resonates on a European scale: the shortage of truck drivers. In its latest study on the subject published in November 2022, the IRU mentioned between 57,000 and 80,000 unfilled positions in Germany, and the situation is tending to worsen, particularly due to retirements that will accelerate in the coming years. Today, about 30,000 truck drivers leave the profession each year for age reasons, while only 15,000 new drivers enter it.

At a public hearing in the German Parliament entitled "Getting the freight transport and logistics sector out of the crisis", organised on 27 March 2023 on the initiative of the CDU/CSU parliamentary group, Dirk Engelhardt raised the spectre of a British-style scenario and warned of the risk of supply disruption. "In a year or two we will have conditions similar to those in the UK due to demographic developments. However, the lack of drivers can no longer be compensated by the Eastern European Countries which are facing identical difficulties".

Last February, several professional associations in the transport and logistics sector sent a letter to the Parliamentary State Secretary of the BMDV, Oliver Luksic, calling for a profound reform of the training of professional drivers, an adaptation of the regulations on the minimum age and flexibility in the issuance of driving licences and the recognition of foreign licences.

Professionals are also aware of the need to improve working conditions to encourage vocations. At the public hearing in the German parliament, Ronny Keller of the services trade union Verdi stressed the need for decent wages, but also "decent working conditions on the road and in rest areas". As everywhere in Europe, Germany lacks parking spaces. The deficit is estimated at 40,000 places. The employees’ representative also campaigned for "route planning that reconciles family and work life and reduces time away from home".

Germany, like many European countries, is facing inevitable growth in road freight transport, in a context of ageing and congested infrastructure, staff shortages, and very ambitious energy transition targets. A multi-billion equation...

[1] ACEA, « Vehicles in use Europe 2023 », January 2023.

[2] Intraplan Consult GmbH, TTS TRIMODE Transport Solutions GmbH, on behalf of the Federal Ministry of Digital Affairs and Transport: "Prognose 2022 - Gleitende Langfrist Verkehrsprognose 2021-2022", mars 2023

[3] AMÖ, BGL, BIEK, BWVL, DSLV, VDA, VDIK, ZVEI, Dekarbonisierung des Straßengüterverkehrs : Passende Rahmenbedingungen und schnelle Umsetzung des Masterplans Ladeinfrastruktur II, novembre 2022

To read this article in Pdf, please fill in the form below

Our latest articles

-

7 min 03/03/2026Lire l'article

-

Subscriber France: Road transport prices remained almost stable in January

Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article