DOSSIER. Road freight transport in the Provence-Alpes-Côte d'Azur region has experienced significant growth in 5 years. This is based on strong growth in internal traffic flow and controlled erosion of inflows and outflows.

By its geographic position, its manufacturing fabric and its network of ports, with in particular the Grand Port Maritime de Marseille, the Provence-Alpes Côte d'Azur region makes logistics a strategic focus for development, as we saw in our previous article devoted to the economic panorama. This activity is naturally favorable to the development of road freight transport. Moreover, of the approximately 70,000 jobs identified in the region's companies that have transport and logistics as their core business, 23.8% are jobs for haulage and long-haul truck drivers, and 19.7% are jobs for delivery drivers.

Growth since 2016

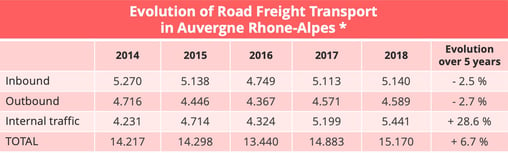

In 2018, the regional traffic flow of French flag road freight transport crossed the 15 billion tonne-kilometer mark, thanks to an increase of 2% compared to 2017 and 6.7% over 5 years. The most notable increase came from internal traffic flow in the region, which represented 36% of total flows in 2018 and increased by 4.7% compared to 2017. The increase is spectacular, as over 5 years it reached 28.6%.

* in millions of tonne-kilometers transported - Source : SDES, Road Freight Transport Survey

Since 2017, internal flow has overtaken inbound flow as the main source of traffic. The latter has in fact experienced an erosion of 2.5% over 5 years, as have outflows (-2.7%), and the recovery observed since 2016 has not yet made it possible to return to 2014's levels.

The OTRE points in particular at competition from low cost European countries. "The number of kilometers traveled by a truck in the region has decreased, and consequently the revenue too, which is not the case for our rather unscrupulous and unethical competitors", underlines Olivier Riandée, director of Provence Distribution Logistique in an interview published in July 2019 by the Journal des Transports, a publication of the PACA Regional Observatory of Transport (ORT). In the region, “96% of drivers employed in freight activities are truck drivers. Nearly 7 out of 10 freight drivers work in short distance or regional transport compared to 1 in 2 nationally”, specifies the 2018 regional report of the OPTL PACA (Prospective Observatory of professions and qualifications in Transport and Logistics).

3,900 road freight transport establishments

According to this same OPTL report, the road freight transport sector had as of December 31, 2017 around 3,900 establishments in Provence-Alpes-Côte d'Azur, of which 1,864 employ salaried workers and just over 2,000 are the self-employed. In the first category, 66% of establishments had between 1 and 9 employees as of December 31st, 2017, 29% between 10 and 49 employees and 5% more than 50 employees. "Road freight transport, strictly speaking, is the most representative area of the sector since it brings together almost half of the salaried workforce (49%), or 24,333 employees", specifies the OPTL.

Specialization by branch such as fruit and vegetables, by geographical routes such as to Corsica or Italy: the road carriers in the region can capitalize on a certain number of specific assets. PACA also draws on a significant population catchment area, conducive to the delivery of consumer goods. The local industrial fabric, on the other hand, remains modest, if we compare it to, for example, the powerful neighbouring region that is Auvergne Rhône-Alpes.

A valuable framework of ports

But the major economic driving force for carriers in the region undoubtedly remains the role of PACA as the southern gateway for France and southern Europe in general, even if this role is hotly contested by neighboring countries. “The strength of RFT in the Provence-Alpes-Côte d'Azur region is the proximity to the sea. The ports and the Grand Port Maritime de Marseille in particular provide an open door to trade with other countries via the Mediterranean. The diversity of sites offered by the different parts of the region in general, and the port in particular, makes it possible to carry out land transport of different products (bulk, hydrocarbon, containers, cereals) to other regions of France and Europe ", highlights Jean-Yves Astouin, president of the FNTR Provence-Alpes-Côte d'Azur and general manager of Provence Astouin, writing in the Journal des Transports of the PACA ORT. However, a caveat must be noted: “The lack of highway infrastructure is a weakness, in particular for serving the port's western catchment areas. The creation of the Fos-Salon link and the Arles bypass would facilitate transport,” said the president.

“The ports of Marseille-Fos, Toulon and Nice constitute natural outlets for goods, the attractiveness of which must be strengthened. The objective is to entice ships to converge towards the ports on the Mediterranean coast, rather than towards Antwerp or Rotterdam. It is therefore necessary to support the ports and all the players in the port chains, in an approach via the Rhône-Saône corridor and by aiming for complementarity between the ports on the Mediterranean coast. It is not in the territory's interest to see goods pass through “corridor ports”, to suffer the disturbances, without deriving the least benefit. It is by anchoring the logistics chains in our territories that we will fix traffic in our ports and that we will create lasting value and jobs," underlines the Regional Prefect, Pierre Dartout, in an editorial published in the ORT Transport Journal. For this, he recommends improving the connectivity of ports, by "maintaining a quality road service". As we have seen, the carriers are calling for real improvements ...

Strengthening the competitiveness of rail and waterways to develop the hinterland is also on the agenda, even if this move has already been largely initiated by the GPMM, notably under the leadership of the former president of the port management board, Christine Cabau Woehrel. Extending the hinterland to Switzerland, Southern Germany, the Grand Est region and even Benelux constitutes for the GPMM a strategic objective. The region is, in any event, quite dynamic in terms of combined transport, in particular around four zones: Avignon, Marseille, Fos and Miramas. "These 4 sites process around 280,000 ITUs per year, with 70 weekly CT connections", assesses a study published in January 2019 by the Urban Planning Agency of the Marseille Agglomeration (AGAM).

Closer relations with carriers

If a modal shift becomes part of the agenda, the port has also made efforts to streamline relations with road carriers. “The Marseille-Fos port community has become aware of the importance of the road carrier in the logistics chain. Today, we are invited to attend briefings that concern the development of the GPMM and the terminals used by the road carriers. As the director of my own transport company, I often go on the ground, to see what drivers are facing. I still have my truck license, and I will sometimes load or unload a container in Fos. If I notice any anomalies, I report them during the briefings, in order to improve the security and the smooth transit of the flow of goods," testified Jean-Yves Astouin in an interview granted in October 2018 to MGi, the company which manages the Cargo Community System of the port.

This idyllic situation however came under some strain during the social movements which agitated French ports before and during the debate on the pensions reform bill end of 2019-early 2020. According to a survey carried out at the time by the FNTR, PACA was in the Top 3 of the most affected regions, with 46% of PACA's road transport companies reporting a loss in revenue caused by these movements. "Companies with a multimodal rail-road activity have also been impacted by social movements, in particular due to the major blockades of container trains", underlined the FNTR.

A few weeks after this, the port of Marseille-Fos announced the launch of a Commitment Pact, as the key to a series of exceptional commercial measures to win back customers. “We deplore the existence of a two-speed commercial policy. The port fears for its international attractiveness and wants to bring back the shippers but has not taken into consideration the thousands and thousands of euros of deadweight losses which the road transporters have had to face. Some have thrown in the towel, others are very weakened", affirmed Jean-Christophe Pic, the president of the FNTR, in a press release of February 2020.

In light of the pandemic that has occurred since, this episode could almost seem anecdotal. It is however an opportunity to underline that the year 2020 will certainly be very difficult for the carriers in the PACA region, who have accumulated a number of setbacks. Road freight transport as a whole has repeatedly called for a support plan commensurate with its strategic role that became abundant during lockdown. Hopefully it will come to fruition, for the good of PACA's road carriers ... and those of the whole of France!

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article